Tired of chasing late payments and confusing your clients with the wrong documents? The fix is simpler than you think. Here’s the quick win: send an invoice to bill for a specific job, and a statement to summarize account activity over time.

Getting this right isn't just about good bookkeeping; it's crucial for clear client communication and getting paid faster.

Sending the Right Document at the Right Time

Dealing with late payments? It’s a frustratingly common problem for business owners, but the fix might be sitting in your process. Often, the holdup happens because the wrong document was sent. Sending a statement when an invoice is what's needed creates confusion and can seriously slow down your cash flow.

This simple mix-up between an invoice and a statement can put a strain on even the strongest client relationships.

To get paid on time, you have to be perfectly clear with your payment requests. Think of an invoice as a bill for a specific job—it breaks down exactly what the client owes and why. A statement, on the other hand, gives a bird's-eye view of the account's history. It's great for their records but not the right tool for requesting payment on a recent transaction.

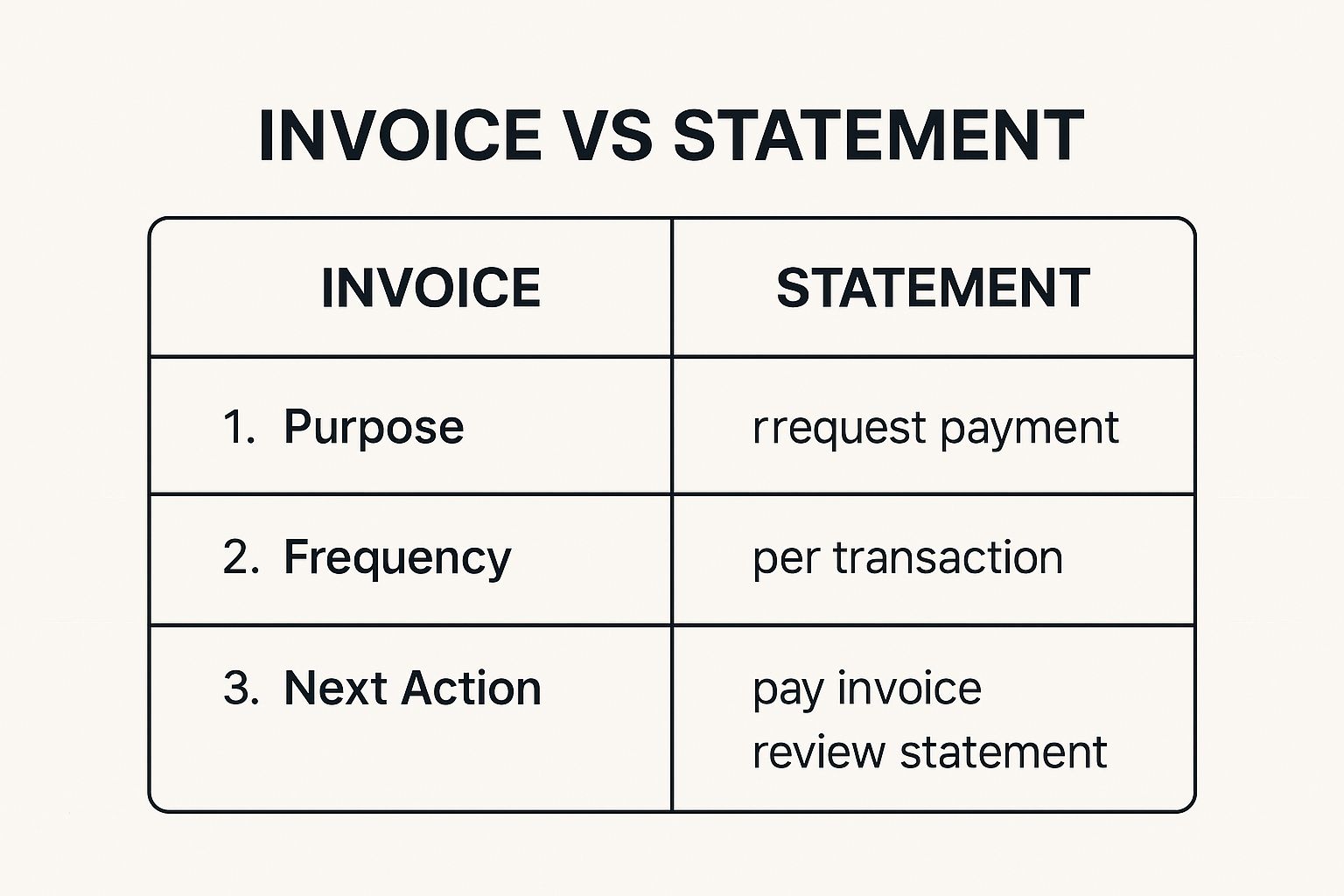

At a Glance: Invoice vs. Statement

Let's cut through the noise. This table lays out the fundamental differences between an invoice and a statement.

Attribute | Invoice | Statement |

|---|---|---|

Primary Purpose | To request payment for a specific transaction | To summarize account history and show a balance |

Timing | Sent after a good or service is delivered | Sent on a recurring schedule (e.g., monthly) |

Content | Itemized list of products/services, costs, due date | Chronological list of invoices, payments, credits |

As you can see, the purpose and timing are completely different. One is a call to action, and the other is a report.

This visual helps clarify the distinct roles each document plays, showing how an invoice drives an immediate action while a statement offers a periodic review.

Ultimately, an invoice is transactional—it’s meant to trigger a payment. A statement is informational—it prompts the client to review their account activity. For a deeper dive, check out our guide on how to send an invoice the right way.

Nailing this difference is the first real step toward creating a more professional, predictable, and effective billing system for your business.

Breaking Down the Invoice: What You Need to Know

Have you ever looked at a payment request and had no clue what it was for or if you'd already paid it? That’s exactly what a bad invoice does to your clients. A good invoice, on the other hand, is more than just a bill—it’s a crystal-clear communication tool that gets rid of the guesswork and helps you get paid faster.

At its core, an invoice is a formal, legally recognized document that outlines a transaction. It’s your official request for payment, detailing exactly what goods or services you provided, how much they cost, and when the payment is due. Unlike just shooting off an email asking for money, a proper invoice creates a paper trail that protects both you and your client, making it essential for managing your accounts receivable.

The invoice above is a great example of a clean, professional layout. Every single element, from the unique invoice number to the itemized list of services, has a purpose. This kind of structure makes it incredibly easy for clients to see what they're paying for, which helps head off potential disputes before they even start.

The Key Ingredients of a Professional Invoice

For an invoice to do its job, it needs to include a few critical pieces of information. If you miss any of these, you're just asking for payment delays or, even worse, rejections.

Here’s a quick checklist of the absolute must-haves:

Your Business Information: Your company name, address, and contact details need to be front and center.

Client Information: The full name and address of the person or business you're billing.

Unique Invoice Number: A sequential, one-of-a-kind number for easy tracking and reference.

Invoice Date & Due Date: Clearly state when you sent the invoice and when you expect to be paid.

Itemized List of Services/Products: A detailed breakdown of each item, including a description, quantity, rate, and a subtotal for each line.

Total Amount Due: The final bottom line, factoring in any taxes, discounts, or additional fees.

Payment Terms: Simple instructions on how to pay (like bank transfer details or a payment link) and any policies on late fees.

Getting these details right is so important that it’s fueling huge investments in technology. The global market for invoice management software is expected to jump from $15 billion in 2025 to around $40 billion by 2033. This growth is all about businesses wanting to automate the process to cut down on errors and speed up cash flow.

For freelancers, nailing the invoice process is a total game-changer. You can find more specific tips in our guide to creating the perfect invoice for freelancers.

When you break it all down, it's obvious that the invoice is your number-one tool for requesting payment. You have to make it count.

Understanding the Role of a Financial Statement

Ever found yourself digging through a mountain of old invoices, trying to piece together a client's payment history? It's a frustrating and inefficient way to figure out what's been paid and what's still outstanding. This is exactly where a well-structured financial statement comes in, transforming a confusing paper trail into a clear, chronological story of your client's account.

Unlike an invoice, which is a direct request for payment for a specific sale, a statement is a summary document. Its main job isn't to bill for a new transaction but to give a complete picture of a client's account over a specific time frame, like a month or a quarter. Think of it less like a bill and more like a detailed account summary.

This example shows how a statement neatly organizes all financial activity into an easy-to-read format. It empowers clients to track their spending and confirm their payments without having to sort through multiple documents.

Key Components of a Statement

For a statement to be truly useful, it needs a few essential parts that tell the complete story of the account's activity. If you miss any of these, you're just inviting confusion and a lot of back-and-forth emails.

A solid statement always includes:

Starting Balance: The total amount owed at the very beginning of the period.

Chronological Transactions: A line-by-line list of every invoice, payment, credit, and adjustment that occurred during that period.

Ending Balance: The final, total amount due at the end of the statement period.

This clear structure is fundamental for maintaining accurate and transparent records for both you and your client—a key part of professional bookkeeping. If you want to dive deeper into the nuts and bolts of proper record-keeping, check out our guide on financial reporting for small business.

Real-World Use Case: A Creative Agency’s Billing Overhaul

A boutique branding agency was constantly juggling multiple small projects for the same clients. They sent out invoices for each project milestone, but their clients quickly lost track, leading to a lot of partial and late payments.

The solution was simple: they started sending monthly statements. This gave clients a single, consolidated document showing every outstanding invoice, every payment made, and the total balance due. The result? Their average payment time dropped by an impressive 40%, and the administrative hours spent on follow-up emails plummeted, freeing up their team to do what they do best—creative work.

When to Send an Invoice vs. a Statement

Ever feel like you’re sending documents into a void, wondering why payments are slow or clients seem confused? More often than not, the culprit is using the wrong document at the wrong time. Here’s the simple fix: send an invoice to request payment for a specific job, and send a statement to give a summary of the account's history.

Knowing the precise moment to send an invoice versus a statement is fundamental to clear financial communication and maintaining a healthy cash flow. It’s not just about getting paid; it’s about making the process completely frictionless for your clients, which builds trust and keeps them coming back.

Actionable Guide: When to Send an Invoice

An invoice is a direct call to action. It should go out the door as soon as you've delivered a product or finished a service. Any delay in sending the invoice only delays your payment.

The best times to send an invoice are pretty clear-cut:

After Completing a One-Off Project: A web designer finishes a new logo and immediately sends an invoice for the agreed-upon price.

Upon Shipping a Product: An e-commerce store ships an order and emails the invoice to the customer right away.

When a Project Milestone is Reached: A consultant completes the first phase of a three-month project and invoices for that specific block of work.

Actionable Guide: When to Send a Statement

A statement, on the other hand, plays a different role. It’s a bird's-eye view of a client's account over time, which makes it perfect for ongoing business relationships.

You’ll want to send a statement in these situations:

To Summarize Monthly Activity: A marketing agency sends a statement on the first of each month, listing all invoices sent and payments made during the previous month.

As a Gentle Payment Reminder: If a client has a few overdue invoices, a statement provides a consolidated, non-confrontational summary of their total outstanding balance.

For Clients on Credit: A B2B supplier can provide a monthly statement to a retail client who makes frequent purchases on credit.

Sending the right document is step one, but the entire accounts payable process can still be a huge headache. Manual invoice processing still takes an average of 14.6 days and costs around $15 per invoice, with nearly 39% of them containing errors. If you're curious, you can discover more insights about accounts payable automation statistics and see how new tools are tackling these old problems.

For more on this, check out our detailed comparison of billing vs invoicing.

Now that you know exactly when to use each document, the next step is putting this knowledge into practice.

Automating Your Billing Workflow with growlio

Let's be honest: chasing payments and manually piecing together invoices is a drag. You can know the difference between an invoice and a statement inside and out, but actually creating and sending them is a time-suck, and one that's surprisingly easy to mess up. The best solution? Put it on autopilot. Set up a system once and let it do the heavy lifting of billing, sending reminders, and tracking payments for you.

Automating your billing workflow takes it from a necessary chore to a polished, reliable part of your business. That means no more forgotten invoices, fewer uncomfortable follow-up emails, and a much clearer picture of your cash flow. It's really about getting paid faster with a lot less hassle.

How to Automate Invoices and Statements: A 3-Step Guide

Setting up automation in growlio is refreshingly simple. Here’s a step-by-step process to get your billing automated:

Create Your Templates: In your growlio dashboard, navigate to Settings > Document Templates. Design professional templates for both your invoices and statements. Make sure to include your logo, contact details, and clear payment terms to ensure every document you send is consistent and professional.

Set Up Recurring Profiles: For retainer clients, go to Recurring > New Recurring Invoice. Just specify the client, the amount, and how often it should be sent (e.g., monthly on the 1st). growlio handles the rest, automatically generating and emailing the invoice on schedule.

Schedule Automated Statements: For clients with ongoing work, go to Customers > select a customer > Create Statement. Set up a schedule for monthly statements. The system automatically gathers all their invoice and payment activity for that period, calculates the final balance, and sends it off.

Pro Tip: For high-value clients with multiple ongoing projects, use growlio's "Aged Receivables" report to create a custom statement. This document breaks down their outstanding invoices by how long they’ve been overdue (e.g., 0-30 days, 31-60 days, 61+ days). It provides a strong visual cue for them to prioritize older payments, which can really help your cash flow without forcing a direct, awkward conversation.

The real goal here isn't just saving time—it's about building a predictable and professional financial process. To dig deeper into optimizing these systems, it’s worth mastering financial workflow automation.

This view of the growlio dashboard shows exactly how you can track the status of every single invoice—sent, viewed, paid, or overdue—all in one spot.

Having this centralized view gives you an instant read on your accounts receivable, which helps you make smarter financial decisions on the fly. Strong billing is a key part of running a solid business, and you can learn more about improving your entire process in our guide to https://www.growlio.io/blog/document-and-workflow-management.

Common Questions Answered

It's easy to get tangled up in the web of financial documents. You've got invoices, statements, receipts, purchase orders... what's what? Don't worry, it's a common trip-up.

Let’s quickly clear the air on a few of the most frequent questions business owners have about all this paperwork. Getting these straight is a huge step toward a smoother financial process.

Is an Invoice Actually a Legal Document?

Yes, absolutely. Think of an invoice as more than just a bill; it's a legally binding agreement. Once your client receives and accepts the goods or services you've delivered, that invoice becomes the official record of their promise to pay you based on the terms you set.

This is why they're so important. If a client goes silent and payment is long overdue, a proper invoice is the core piece of evidence you'll need if you have to resort to a collections agency or legal action.

How Is a Receipt Different From an Invoice?

The key difference here is all about timing and function. An invoice is a request for payment, while a receipt is proof of payment.

An invoice says, "You owe me this amount." It's sent before you get paid.

A receipt says, "You've paid me this amount." It's sent after you get paid.

Simply put, a receipt officially closes the transaction. It acts as the buyer's proof of purchase and your record of income received.

What About Purchase Orders?

A purchase order (PO) comes into play right at the beginning of a transaction, well before an invoice is even created. It's a document sent from the buyer to you (the seller) to formally place an order.

The PO locks in all the specifics—like what they're buying, how much of it, and the price you both agreed on. After you've delivered, your invoice should reference the original PO number. This creates a perfect paper trail, linking your bill directly to their initial order and making sure everyone's records match up.

Ready to stop wrestling with paperwork and get your finances in order? Stop guessing and start getting paid faster with clear, professional documents.