Tired of refreshing your bank account, waiting for a payment that's weeks overdue? It’s a frustratingly common story for freelancers and small business owners. Here’s the quick win: a clear, professional invoice is the single best tool you have to get paid faster, and you can create one in under five minutes.

Stop Chasing Payments and Start Invoicing Smarter

That feeling of chasing down late payments is something almost every freelancer and small business owner knows. It’s a stressful cycle of checking your bank balance and drafting awkward "just following up" emails, all of which torpedoes your cash flow. But you can absolutely break that cycle. The trick is to shift your focus from chasing payments to creating invoices that are so clear and professional they prevent delays in the first place.

Think about it from your client's perspective. Most payment hold-ups aren't malicious; they're caused by simple clerical issues. A missing invoice number, a vague description of services, or confusing payment terms—these small things create friction. They give your client a perfectly valid reason to pause, ask questions, or just push your invoice to the bottom of the pile to deal with "later."

When you treat your invoice as a critical business document, not just a bill, you signal professionalism and make it incredibly easy for them to hit "pay."

Real-World Impact: A freelance marketing agency we know cut their average payment time from a painful 42 days down to just 11 days. Their secret? They simply standardized their invoice template to include a unique ID, a bolded due date, and detailed line items for every single task. This small audit eliminated all the guesswork for their clients' accounting teams, making the invoices instantly processable.

Of course, smart invoicing is just one piece of the puzzle. For a more complete picture of your financial health, it’s worth the time to Master Small Business Cash Flow Management.

It’s also helpful to get the terminology straight. If you're ever unsure about the lingo, our guide on billing vs invoicing breaks down the key differences.

The bottom line is simple: a smarter invoice leads to smarter cash flow. The first step in learning how to send an invoice effectively is making sure it's built correctly from the ground up.

The Anatomy of a Perfect Invoice Checklist

Before you hit send, run through this checklist. These aren't just suggestions; they are the non-negotiable components that separate an invoice that gets paid immediately from one that gets lost in a client's inbox.

| Component | Why It Matters for Fast Payment | Example |

|---|---|---|

| Your & Client's Full Info | Eliminates confusion and ensures it reaches the right person/department. | Your Business Name, Address, Contact Info & Client's Business Name, Address. |

| Unique Invoice Number | Essential for tracking, referencing, and preventing duplicate payments. | INV-001, INV-002, etc. |

| Clear Dates | The Issue Date and Due Date set clear expectations for payment. | Issue Date: Oct 26, 2023 / Due Date: Nov 10, 2023 |

| Detailed Line Items | Breaks down exactly what they're paying for, preventing questions and disputes. | "Graphic Design - 5 Social Media Posts @ $100/post" |

| Total Amount Due | The most important number on the page. Make it bold and easy to find. | Subtotal: $500, Tax (10%): $50, Total Due: $550 |

| Payment Terms & Methods | Tells the client how and when to pay you, removing friction. | "Payment due within 15 days via bank transfer. A/C #: 123456" |

Making sure every one of these components is present and clear is the fastest way to improve your payment cycle.

Start building better financial habits today. Create your first professional invoice in minutes with a free growlio account.

How to Craft an Invoice That Gets Paid, Fast

There's nothing more frustrating than that email from a client asking, "What is this charge for?" It’s a total time-waster, and it's completely avoidable. A confusing invoice is a delayed invoice, so let’s get practical about building one that’s crystal clear from the get-go.

Here is a step-by-step guide to crafting a perfect invoice:

- Gather Your Information: Before you touch a template, collect the client’s full business name, the correct contact in their billing department, any required project or PO numbers, and the rates you both agreed on. Nailing these details first is the best way to keep your invoice from getting lost.

- Brand Your Invoice: Your logo and business contact details should be right at the top. This immediately identifies who the invoice is from and looks professional.

- Assign a Unique Invoice Number: Give every invoice a unique ID, like INV-2024-087. This number is your best friend for tracking and referencing payments.

- Clearly State Dates: Include both an "Issue Date" and a "Due Date." This leaves no ambiguity about your payment timeline.

Write Descriptions That Leave No Room for Doubt

Vague line items are the number one reason payments get held up. "Consulting Services" just doesn't cut it. You need to be specific and describe the actual value you delivered.

- Don't write: "Marketing Services - $2,000"

- Do write: "Q3 Social Media Management (July-Sept 2024) - $1,500"

- And: "SEO Content Creation - 4 Blog Posts @ $125/post - $500"

This kind of detail makes life easy for the person in accounts payable. They can approve it on the spot without having to hunt down the project manager for context.

Set Your Payment Expectations Loud and Clear

Your payment terms should be impossible to miss. State the due date prominently and list the ways you accept payment (e.g., bank transfer, credit card). You can't expect prompt payment if your terms are hidden or ambiguous. Properly understanding different payment terms helps you set the right expectations from the start, which is key for healthy cash flow.

Pro Tip: Add a "Billing Period" for Retainers

For retainer clients, add a "Billing Period" line (e.g., "Billing Period: October 1 - October 31, 2024"). This small detail is a huge help for their accounting team. It allows them to easily match the invoice to the correct service period, preventing confusion if your payment schedule doesn't align perfectly with the calendar month.

A well-structured invoice does more than just ask for money. It communicates your professionalism and makes it incredibly easy for your clients to say "yes" and pay you on time.

Choosing Your Format and Delivery Method

Ever hit "send" on an invoice and then spend the next week wondering if it even landed in their inbox? The easiest fix is simply choosing a delivery method that gives you peace of mind with delivery confirmations and read receipts. Here’s how to do it.

Step 1: Choose Your Format (PDF is King)

How you package that invoice is just as important as what’s on it. A clean, professional PDF is always the right call. PDFs look the same on every device, they can't be easily altered, and they create a much more professional paper trail.

Step 2: Decide on Your Delivery Method

You have two main options for sending your PDF invoice:

- Email Attachment: This is the classic method. If you go this route, make your subject line crystal clear: "Invoice [Invoice Number] for [Project Name]". Keep the email body itself short and polite, confirming the attachment and reiterating the due date.

- Invoicing Software: This is the upgrade. Dedicated invoicing software is built for this. With tools like growlio, you can send the invoice directly from the platform. The client receives a professional email with a link to view and pay the invoice online.

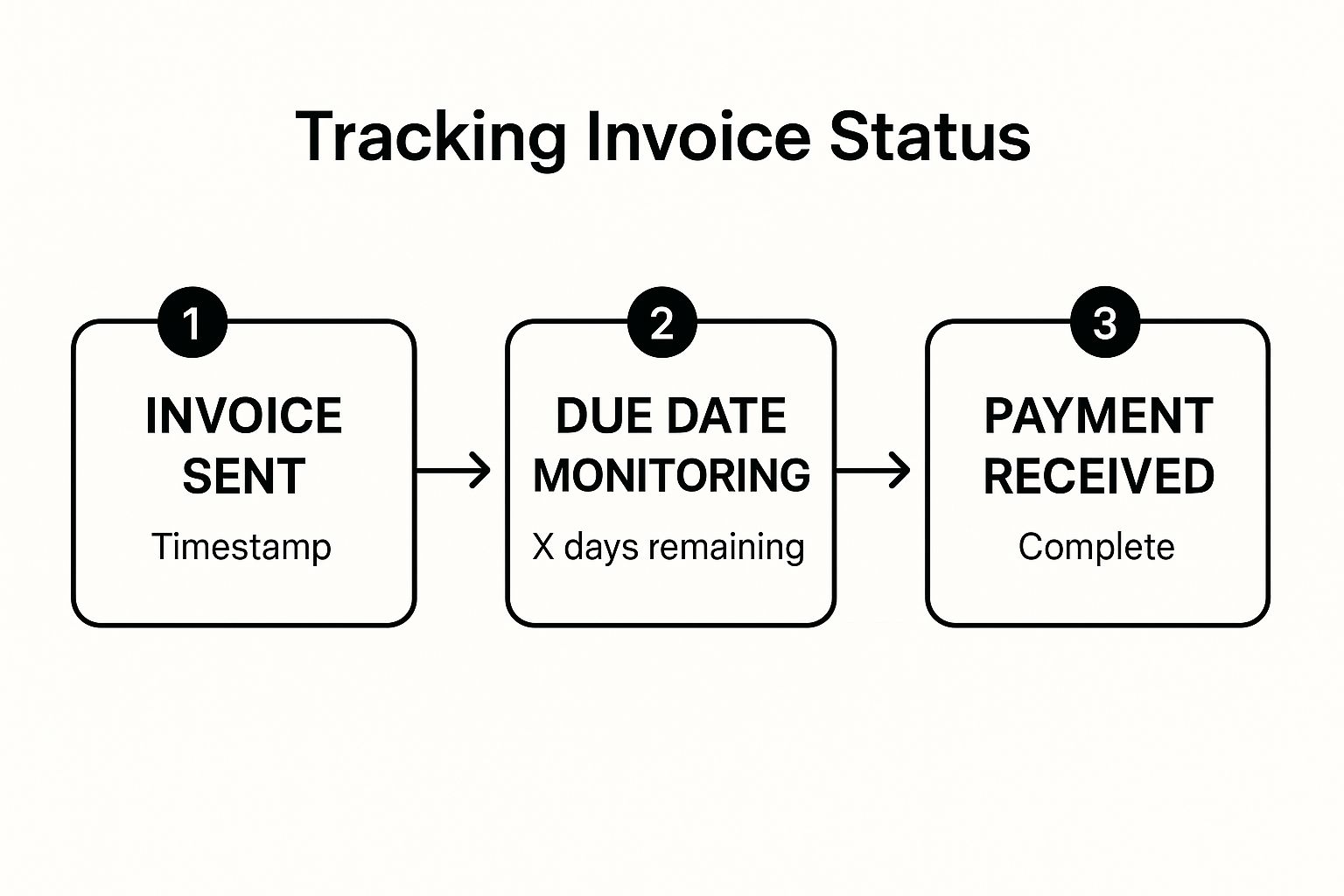

Step 3: Track Your Invoice Status

This is where software really shines. Instead of wondering, you can see the exact moment a client opens the invoice. This visibility turns invoicing from a guessing game into a clear, manageable part of your business. In your growlio dashboard, you can see statuses like Sent, Viewed, and Paid.

Real-World Use Case: The Agency Upgrade

A small branding agency was sending all their invoices from a standard Outlook account. They were constantly chasing clients who claimed they "never got the email." After moving to an invoicing platform, they could see the exact moment a client opened the invoice. That one feature eliminated the "I never got it" excuse overnight and cut their average payment delay by a full week. For more on this, our freelancer invoicing guide has some great tips.

Choosing the right method isn't just about convenience; it's about control and professionalism.

Automating Follow-Ups to Ensure Timely Payment

We’ve all been there. You send an invoice, and then… crickets. The awkward silence and the dread of having to chase a client for money you’ve already earned is enough to strain any business relationship. Here’s a step-by-step way to automate the follow-up process and take yourself out of that awkward equation.

Step 1: Set Your Cadence

A solid follow-up cadence keeps your invoice top-of-mind without making you seem like a pest. Using your invoicing software, set up this simple but effective sequence:

- The Gentle Nudge (3-5 days pre-due date): A polite, no-pressure heads-up.

- The Due Date Reminder (On the due date): A direct and clear reminder.

- The Overdue Alert (7 days past due): A professional but firm alert.

Step 2: Customize Your Templates

Most good invoicing tools let you customize the automated emails. Take five minutes to swap out the generic text for something that sounds like you. A friendly, personalized message feels less robotic and reinforces your client relationship.

Step 3: Activate and Monitor

Once your automated reminders are active, you can monitor the entire workflow. The system will handle the nudges for you, ensuring nothing slips through the cracks. This frees you up from manually tracking dates and composing uncomfortable emails.

This automation isn't just about saving a few minutes; it's about protecting your cash flow and your sanity.

Pro tip: Just because a message is automated doesn't mean it has to sound like a robot wrote it. In growlio.io, you can go to

Settings > Email Templatesto customize your reminders. Inject your brand's voice—whether that's super professional or friendly and casual. A personal touch makes your reminders feel like they're coming from a partner, not a machine. Of course, none of this matters if your emails land in the spam folder. For more on that, check out our guide on how to improve email deliverability.

Time to Master Your Invoicing

We've covered the whole nine yards, from building your invoice to finally getting that payment notification. Remember that sinking feeling of chasing down a late payment? The goal here is to replace that anxiety with a smooth, professional system that keeps your cash flow healthy and predictable.

It really comes down to a handful of smart habits: creating an invoice that leaves no room for confusion, sending it through a reliable channel, and letting automated reminders do the gentle nudging for you. Every one of these steps makes it just a little bit easier for your clients to pay you on time, which is a game-changer for your bottom line.

Key Takeaway: Stop thinking of invoicing as just asking for money. It's the final, professional handshake of a job well done. A polished invoicing process says a lot about the quality of your work and actually helps build stronger client relationships.

If you're ready to get a tighter grip on your finances, our guide on improving small business cash flow is the perfect place to go next.

Ready to stop chasing payments and start getting paid on time? The best way to learn is by doing. Start your free growlio account at growlio.io and send your first professional, trackable invoice in minutes.

Got Questions About Sending Invoices? Let's Get Them Answered

Ever get that nagging feeling you’re sending your invoices at the wrong time? It’s a common worry, but there’s a simple trick that can give you an edge. The goal is to land in your client’s inbox when they’re actually at their desk and ready to tackle administrative tasks.

Based on what we've seen, sending invoices on a Tuesday around 10 AM seems to be the sweet spot. It neatly sidesteps the Monday morning chaos and the Friday afternoon wind-down, often leading to faster payments.

That small timing tweak can make a surprising difference, but it's usually not the only question that comes up. Let’s walk through a few more common hurdles.

What's a Good Timeline for Following Up?

Nobody likes chasing money, and figuring out when to send a payment reminder can feel a bit awkward. The key is to be professional, not pushy.

I always recommend sending a friendly, gentle reminder a few days before the due date. It’s a low-pressure way to keep the invoice top of mind.

If the due date comes and goes, don't panic. Give it 3 to 5 business days before sending your first official follow-up. This short grace period accounts for any internal processing delays on their end and keeps the relationship positive.

Is It Okay to Charge a Late Fee?

Absolutely, but there’s one non-negotiable rule: the late fee policy must be clearly stated in your original contract or agreement. Springing a surprise fee on a client is a surefire way to damage the relationship.

Your contract should spell out the terms, something like, "A 1.5% monthly finance charge will be applied to all balances over 30 days past due." This sets clear expectations from the very beginning.

By thinking through these common scenarios ahead of time, you can handle the entire invoicing process with a lot more confidence.

Ready to stop stressing over the details and start sending professional, trackable invoices every time? The best way to get comfortable is to jump in. You can create your first invoice for free with growlio in just a few minutes and see how simple it can be to take control of your cash flow.