Complete Guide to VAT-Compliant Invoicing in UAE (2025)

Since the introduction of Value Added Tax (VAT) in the United Arab Emirates in 2018, businesses operating in Dubai, Abu Dhabi, Sharjah, and across the UAE are required to issue VAT-compliant tax invoices. Whether you're a freelancer, agency owner, consultant, or service provider, understanding UAE VAT requirements and generating proper tax invoices is essential for legal compliance and maintaining professional client relationships.

What is a VAT Tax Invoice in UAE?

A VAT tax invoice is a legal document issued by a VAT-registered business to a customer when supplying taxable goods or services. In the UAE, businesses with annual revenues exceeding AED 375,000 must register for VAT and issue compliant tax invoices. These invoices must include specific information as mandated by the Federal Tax Authority (FTA) to be considered valid.

The standard VAT rate in the UAE is 5%, one of the lowest globally. A proper tax invoice must clearly show the VAT amount separately from the base price, include both the supplier's and customer's Tax Registration Number (TRN), and contain all required fields specified by UAE tax law.

UAE VAT Invoice Requirements

Required Information on UAE Tax Invoices

According to FTA regulations, every tax invoice must include:

- • The word "Tax Invoice" clearly displayed in Arabic or English

- • Supplier's name, address, and TRN (15-digit Tax Registration Number)

- • Customer's name, address, and TRN (if registered for VAT)

- • Unique invoice number in sequential order

- • Date of supply (invoice issue date)

- • Description of goods or services provided

- • Quantity and unit price for each item

- • Taxable amount (pre-VAT subtotal)

- • VAT rate applied (typically 5%)

- • VAT amount charged (calculated separately)

- • Total amount due including VAT

How to Use the VAT Invoice Generator

1. Enter Your Business Details

Start by filling in your business information including your registered business name, 15-digit TRN (Tax Registration Number), complete business address in the UAE, email address, and phone number. Your TRN is the most critical piece of information - this unique identifier proves your business is registered for VAT with the Federal Tax Authority.

2. Add Client Information

Enter your client's details including their company name, address, and TRN if they are VAT-registered. While the client's TRN is optional for B2C transactions, it's mandatory for B2B invoices where the client is VAT-registered. This information ensures proper tax documentation and allows your client to claim input VAT.

3. Set Invoice Details

Configure your invoice number (use a sequential numbering system), issue date, due date, and currency. While AED is the default and most common currency for UAE businesses, the generator supports multiple currencies including USD, EUR, GBP, and SAR for international transactions. The VAT rate is preset to 5% but can be adjusted for zero-rated or exempt supplies. For accurate time tracking and billing, check out our billable hours calculator.

4. Add Line Items

List each product or service with a clear description, quantity, and unit price. The generator automatically calculates the line total and applies the 5% VAT rate. You can add multiple items by clicking "Add Item" to create comprehensive invoices for complex projects or multiple deliverables.

5. Review and Download

The live preview shows your invoice exactly as it will appear. Review all details for accuracy, then download as PDF or print directly. The generated invoice includes all FTA-mandated fields and follows professional formatting standards expected by businesses across the UAE.

Best Practices for UAE VAT Invoicing

- • Issue invoices within 14 days of supplying goods or services

- • Maintain sequential numbering with no gaps in invoice series

- • Keep copies for 5 years as required by FTA regulations

- • Use clear descriptions to avoid confusion during tax audits

- • Show VAT separately - never combine VAT with the base price

- • Include both Arabic and English for government clients

- • Verify TRN numbers using the FTA's online verification tool

- • Send invoices promptly to maintain healthy cash flow

Understanding the UAE TRN (Tax Registration Number)

The Tax Registration Number (TRN) is a unique 15-digit identifier assigned by the Federal Tax Authority to every VAT-registered business in the UAE. It follows the format 100123456789003 and must appear on all tax invoices, tax credit notes, and official tax documents.

You can verify any TRN using the FTA's online verification portal at tax.gov.ae. This is especially important when dealing with new clients - verifying their TRN ensures they're legitimately registered for VAT and that you're providing accurate documentation for their input tax claims.

VAT Rates and Special Cases in UAE

While the standard VAT rate is 5%, certain goods and services are subject to different treatment:

- Zero-rated supplies (0% VAT): International transportation, exported goods, certain education services, healthcare services, and first supply of residential buildings within 3 years of completion

- Exempt supplies: Residential property rentals (except first 3 years), bare land, and local passenger transport

- Out of scope: Supplies made outside UAE, employee salaries, donations

For zero-rated supplies, you still issue a tax invoice showing 0% VAT and can reclaim input VAT on related expenses. For exempt supplies, you cannot charge VAT or reclaim input VAT. Understanding these distinctions is crucial for accurate invoicing and tax compliance.

Common VAT Invoicing Mistakes to Avoid

Critical Errors That Can Result in Penalties

- • Missing or incorrect TRN - Invoices without valid TRN are not compliant

- • Not showing VAT separately - VAT must be itemized, not included in prices

- • Issuing invoices before registration - Only registered businesses can issue tax invoices

- • Incorrect VAT rate - Applying 5% to zero-rated or exempt supplies

- • Missing invoice numbers - Sequential numbering is mandatory

- • Late invoice issuance - Must issue within 14 days of supply

- • Not keeping records - FTA requires 5-year record retention

- • Using wrong invoice type - Simplified invoices only for transactions under AED 10,000

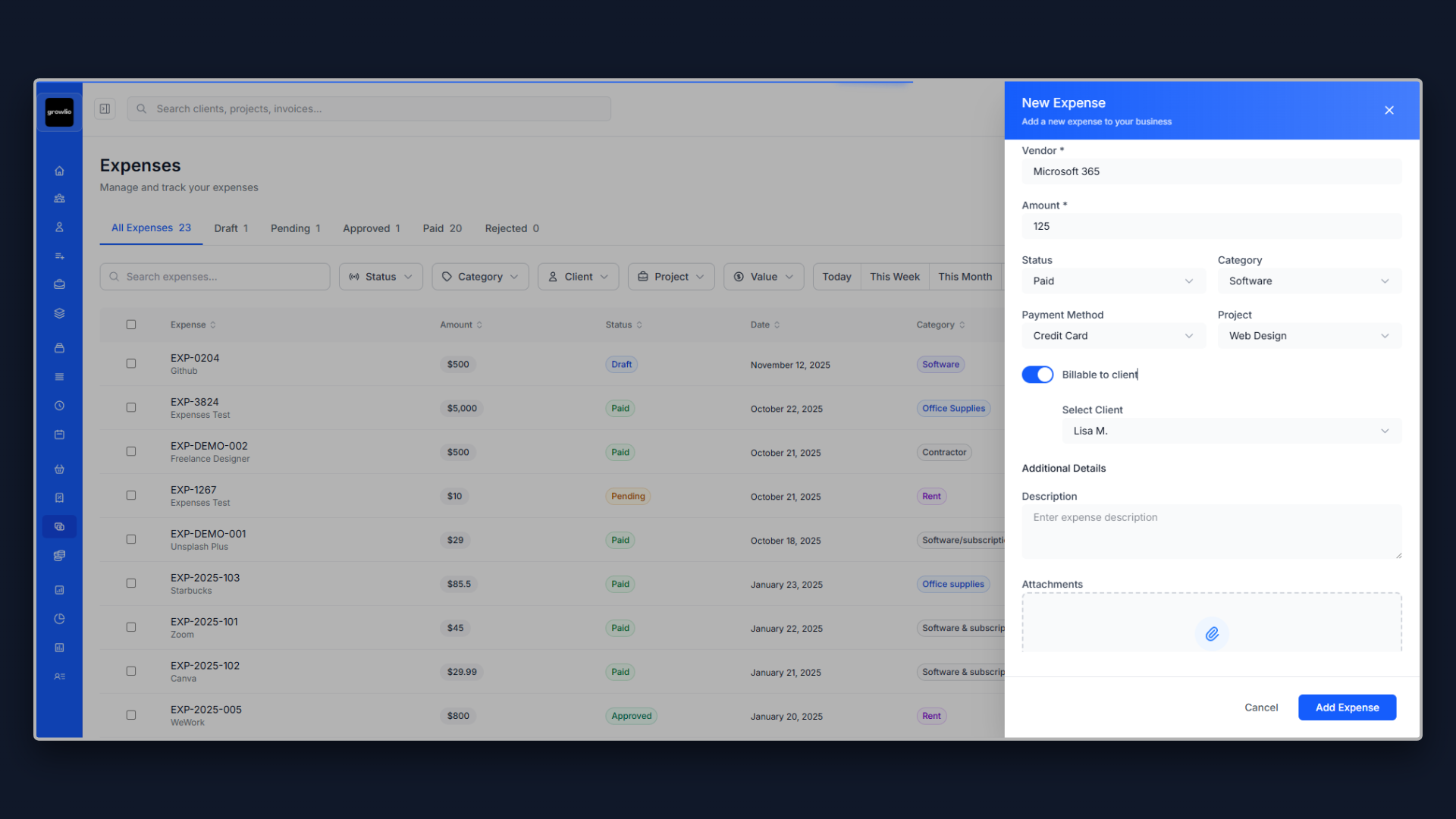

Invoice Generator vs. Professional Invoicing Software

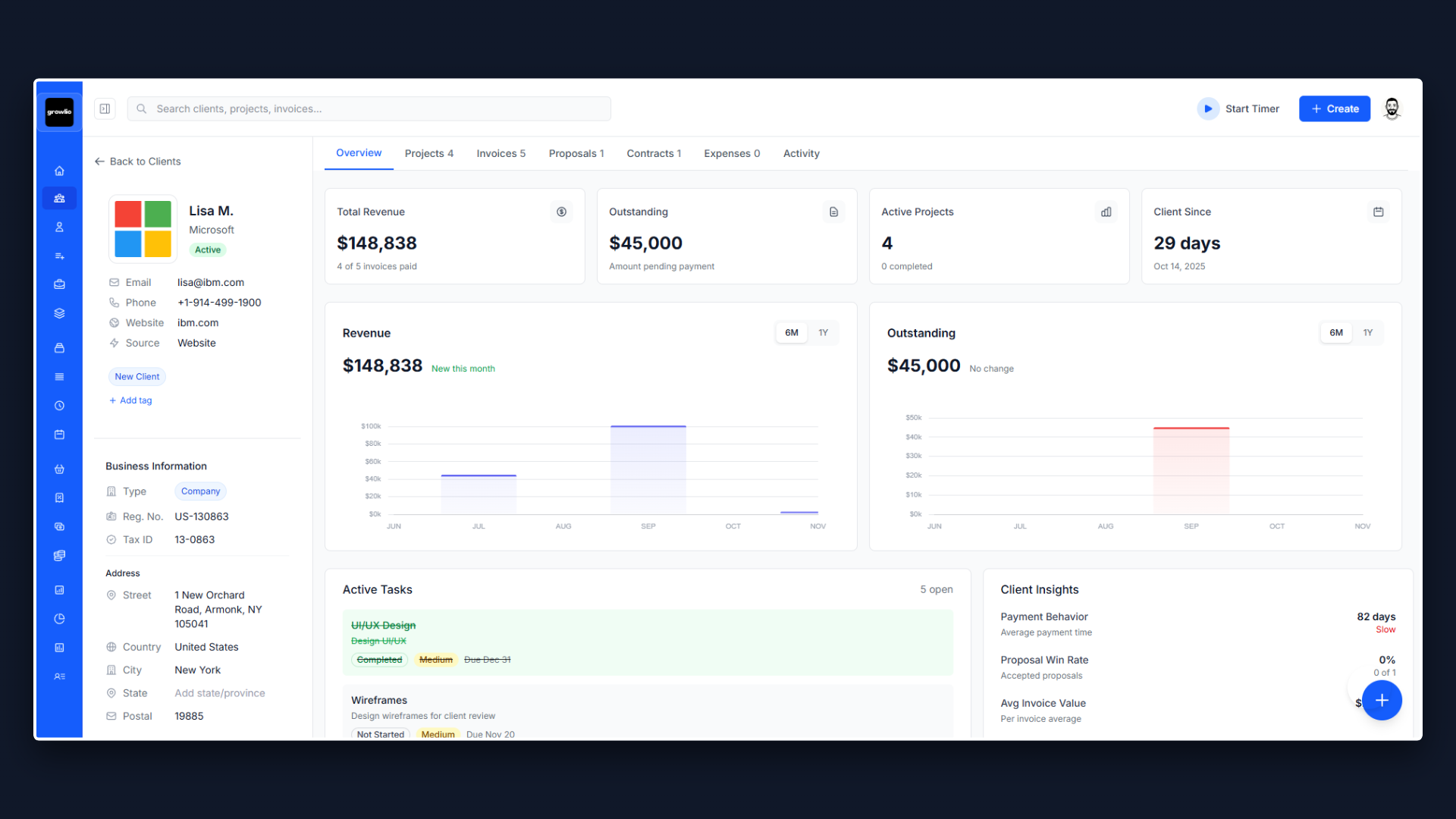

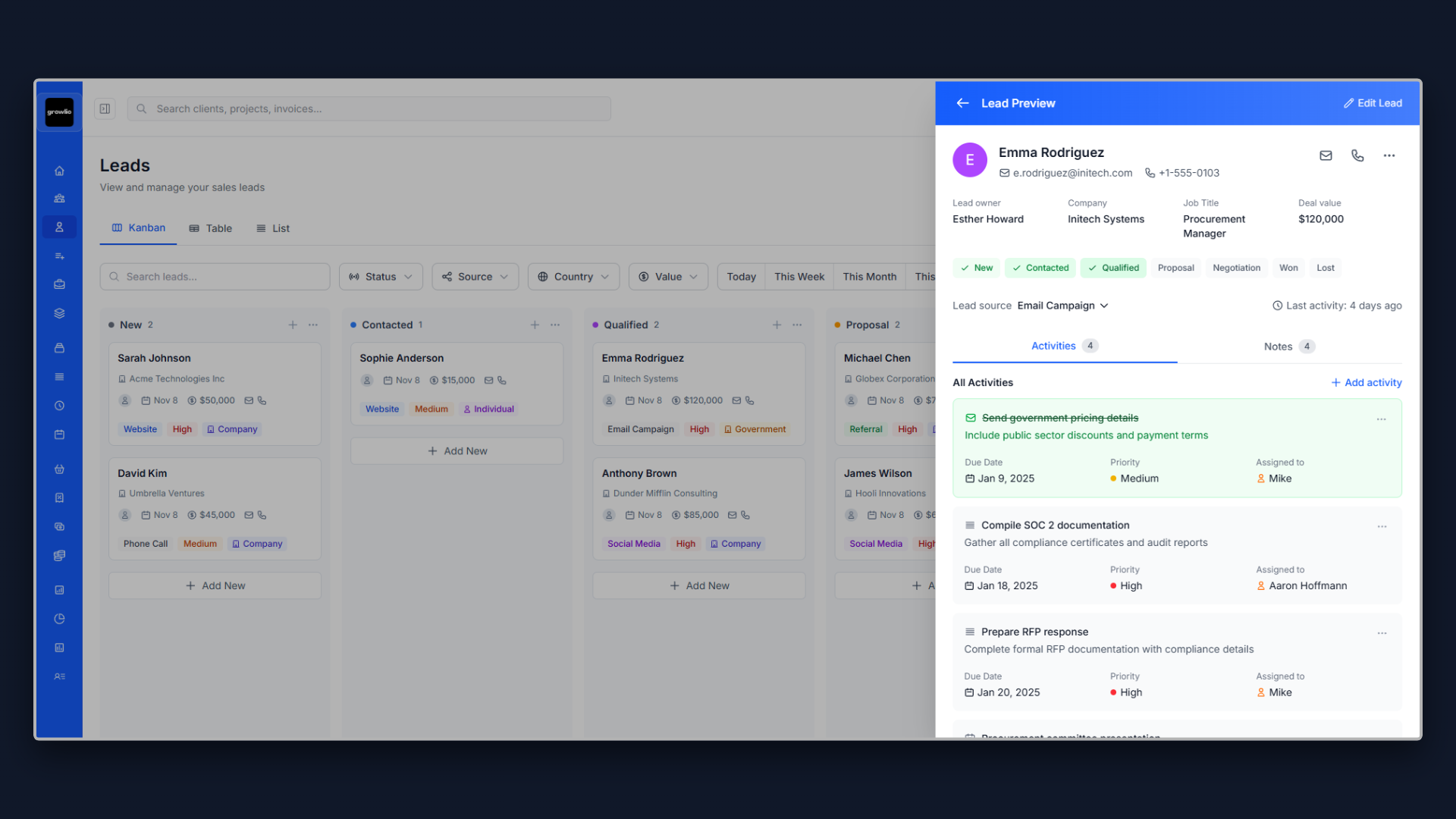

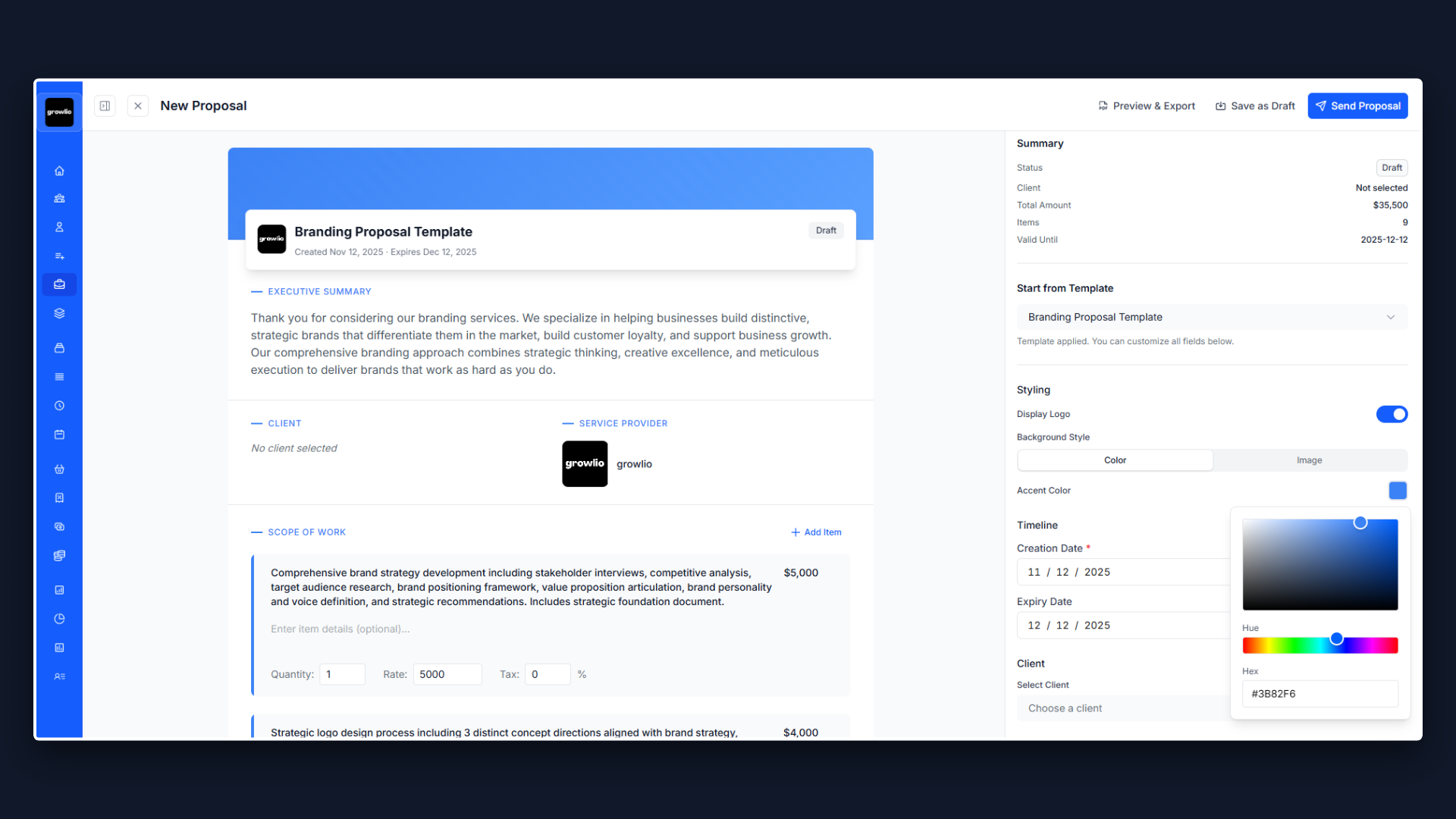

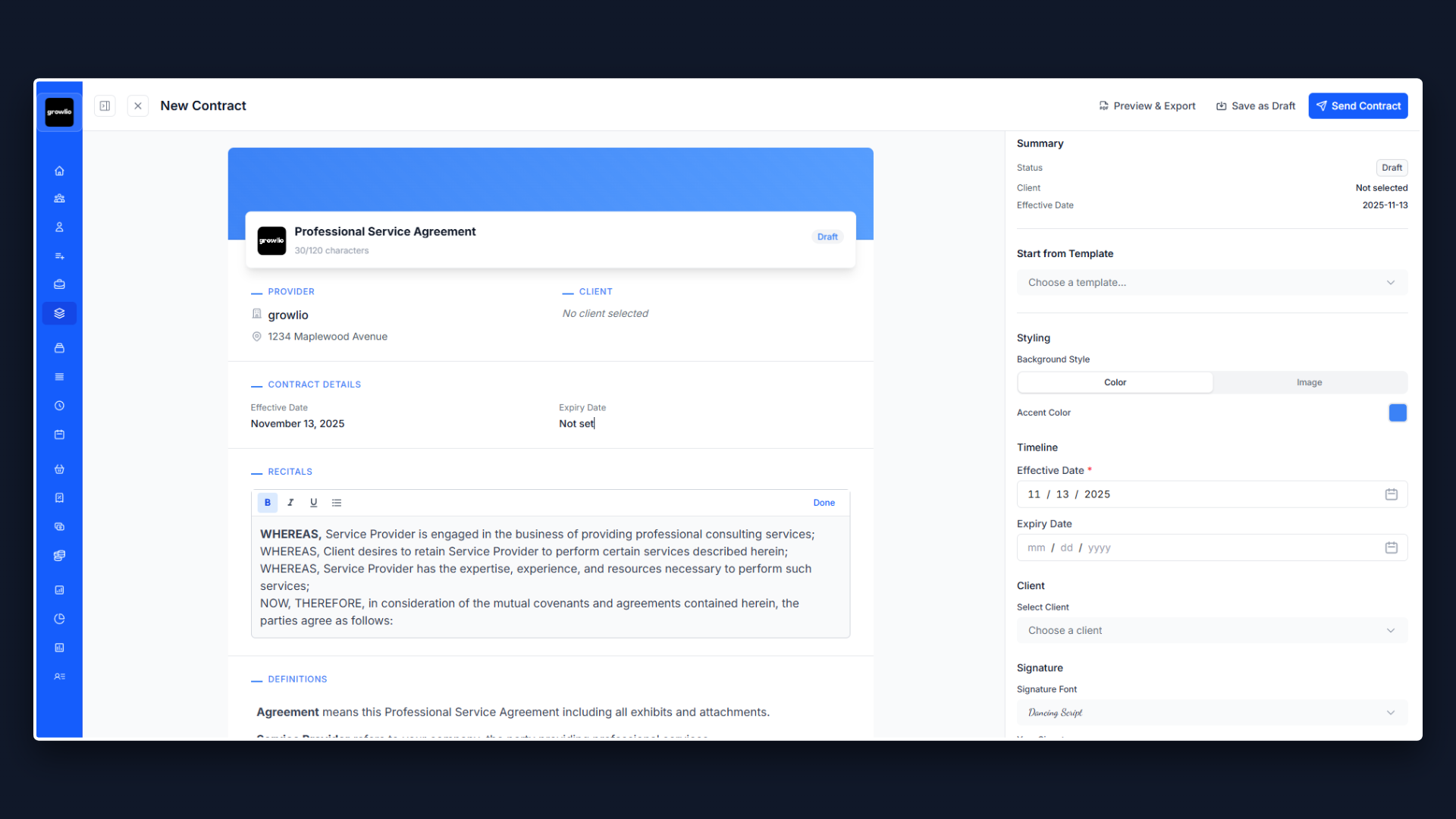

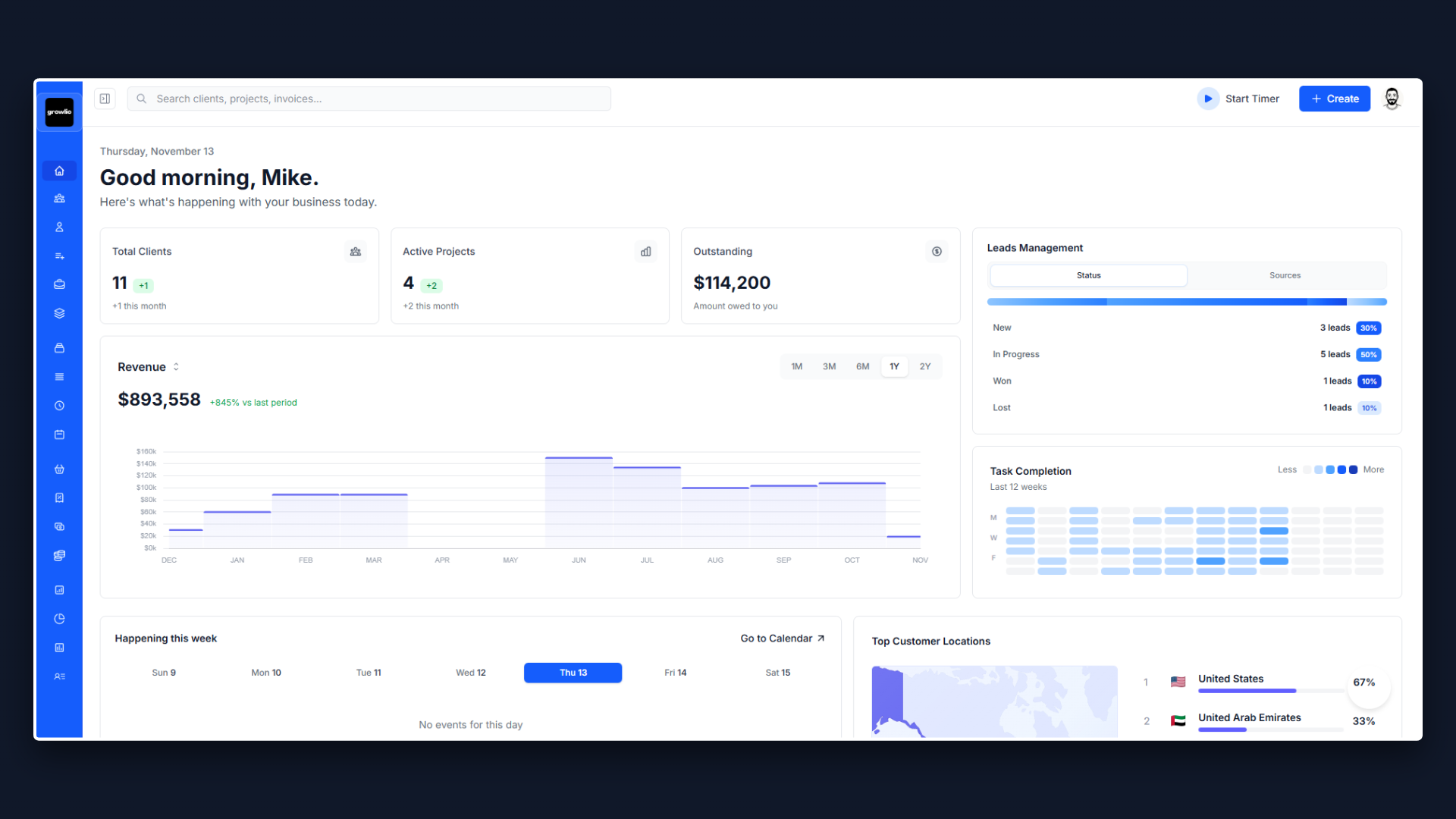

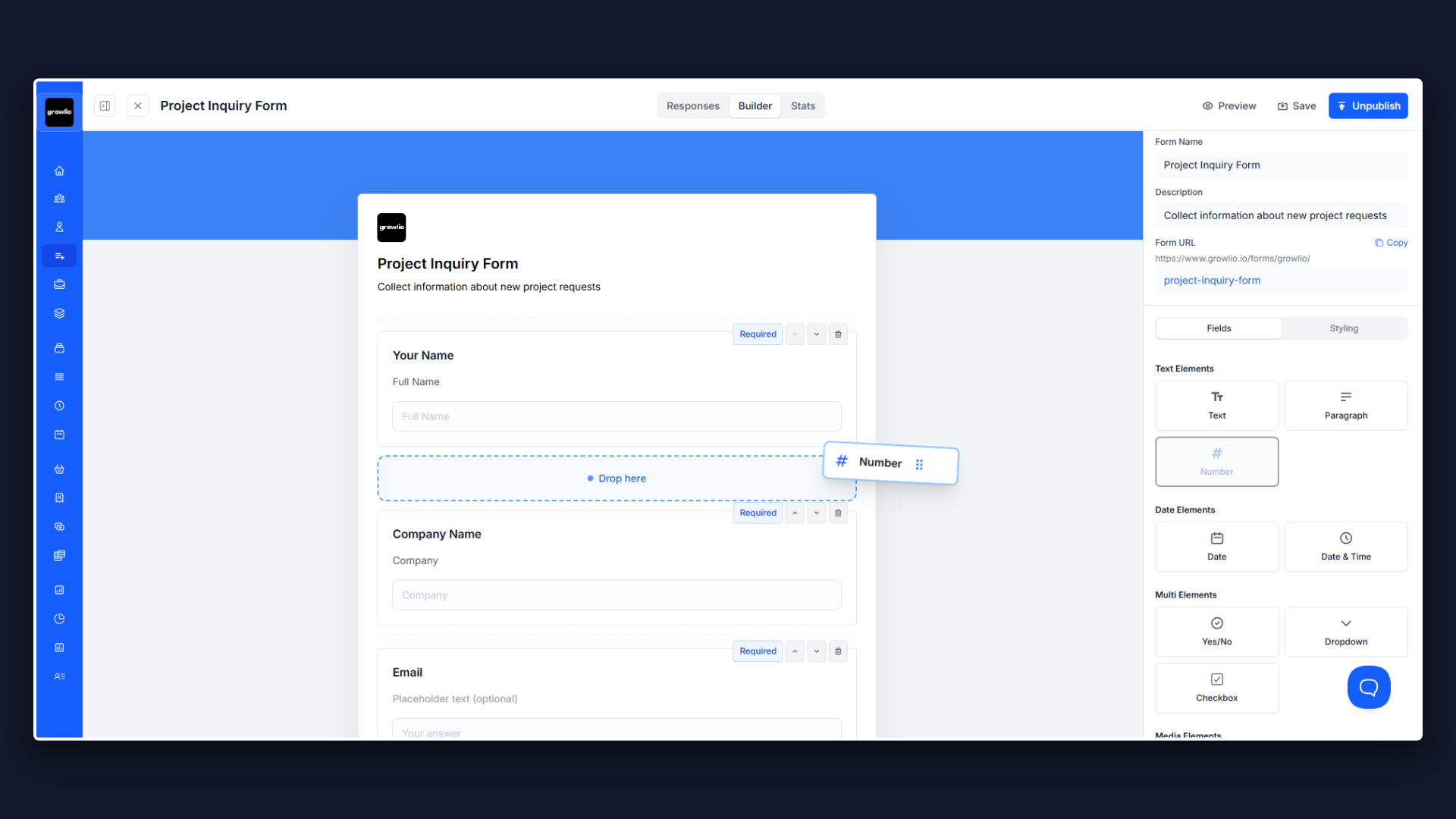

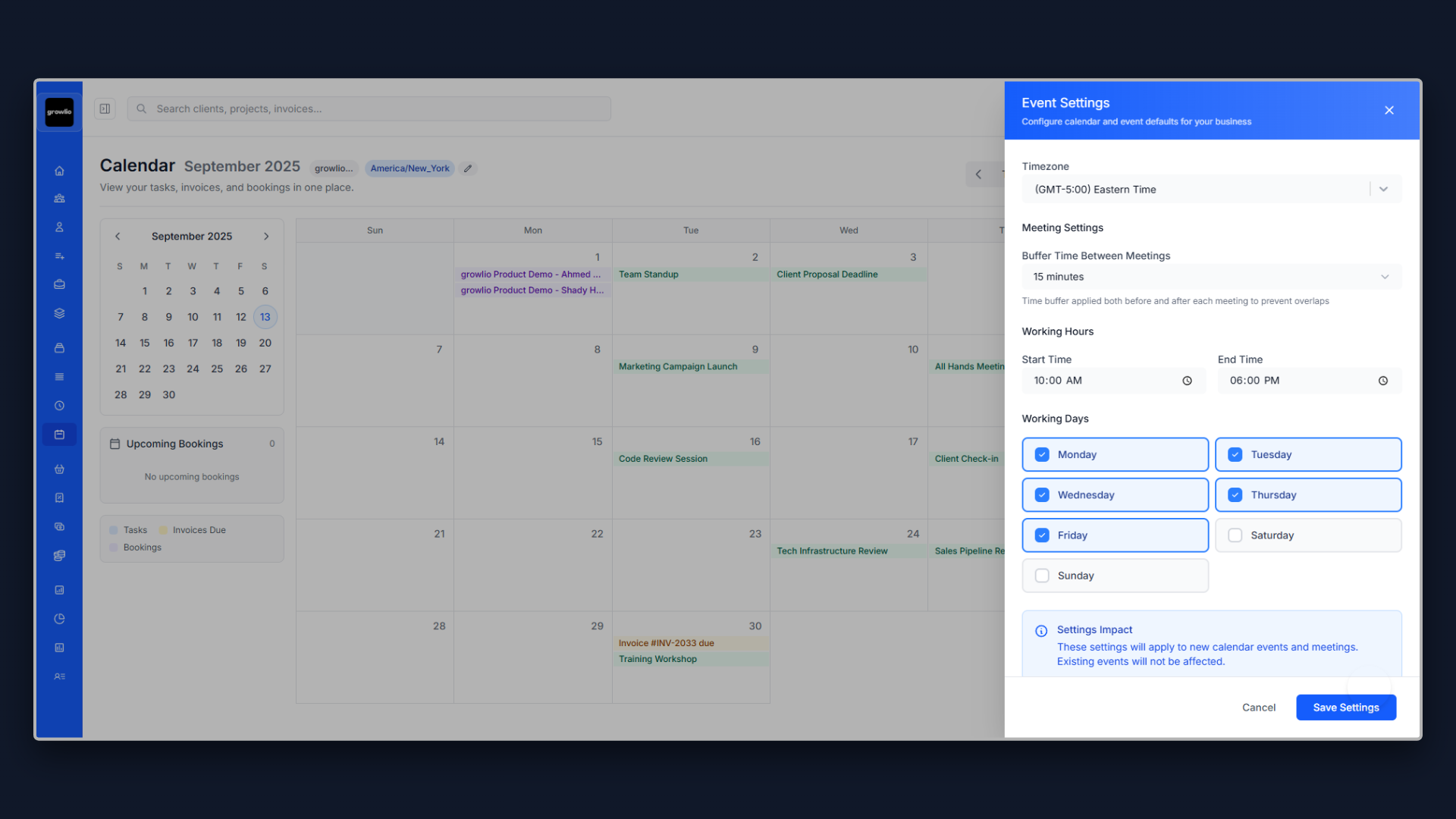

While free invoice generators are excellent for occasional invoicing or starting out, growing businesses benefit significantly from integrated invoicing software. Professional platforms like Growlio offer automated invoice generation, payment tracking, automatic VAT calculations, recurring invoices for retainer clients, and seamless integration with accounting software.

Consider upgrading to professional software when you're issuing more than 10 invoices monthly, managing multiple currencies, tracking payment status across dozens of clients, or need to generate regular financial reports for tax filing. Automation saves hours of administrative work and reduces costly errors that can trigger FTA audits. Start with our proposal templates to win more clients before invoicing them.

Multi-Currency Invoicing for UAE Businesses

Many UAE businesses serve international clients and need to invoice in foreign currencies. While AED is the official currency, you can issue invoices in USD, EUR, GBP, or other currencies. However, for VAT reporting purposes, you must convert all foreign currency amounts to AED using either the European Central Bank (ECB) rate or the UAE Central Bank rate on the date of supply.

When invoicing in foreign currency, clearly state the currency code (USD, EUR, etc.) on the invoice. For your VAT returns, convert the amounts to AED and maintain documentation of the exchange rates used. This ensures compliance with FTA requirements and simplifies tax reporting.

Digital Invoice Storage and Compliance

The FTA requires businesses to maintain all tax invoices, credit notes, and supporting documents for a minimum of 5 years from the end of the relevant tax period. Digital storage is accepted and recommended - it's more secure, searchable, and space-efficient than paper filing.

Store invoices in a systematic, chronological order with backup copies. Cloud storage solutions offer the advantage of automatic backups, accessibility from anywhere, and protection against physical damage or loss. Ensure your digital storage system can quickly retrieve specific invoices by number, client name, date, or amount - this is essential during FTA audits.

Tips for Freelancers and Small Agencies

- • Register for VAT when required - Mandatory at AED 375,000 annual revenue

- • Set up invoice templates - Saves time and ensures consistency

- • Track due dates - Send payment reminders before invoices become overdue

- • Offer multiple payment methods - Bank transfer, credit card, digital wallets

- • Include payment instructions - Bank details, payment terms, accepted methods

- • Follow up promptly - Contact clients 3-5 days after due date

- • Consider early payment discounts - 2-5% discount for payment within 7 days

- • Automate where possible - Use software for recurring invoices and reminders

When Do You Need Different Invoice Types?

UAE tax law recognizes different types of invoices for different situations:

- Tax Invoice: Standard invoice for all B2B transactions and B2C over AED 10,000

- Simplified Tax Invoice: For retail and B2C transactions under AED 10,000 (requires fewer details)

- Tax Credit Note: Issued when correcting or reversing a tax invoice (for returns, discounts, errors)

- Tax Debit Note: Issued when increasing the value of a previous invoice

This generator creates standard tax invoices suitable for most B2B transactions and high-value B2C sales. For retail businesses issuing hundreds of invoices daily, simplified tax invoices may be more appropriate as they require fewer mandatory fields.

Payment Terms and Late Payment Management

Clear payment terms prevent disputes and improve cash flow. For UAE-specific payment solutions, explore our resources on business management tools. Common payment terms in the UAE include:

- Net 30: Payment due within 30 days (most common for B2B)

- Net 15: Payment due within 15 days (for smaller invoices or new clients)

- Net 7: Payment due within 7 days (for rush jobs or high-priority work)

- Due on Receipt: Payment expected immediately (for small amounts or established clients)

- 50/50: 50% upfront, 50% on completion (for large projects)

Include late payment penalties in your terms - typically 1-2% per month on overdue amounts. This incentivizes timely payment and compensates for the cost of delayed cash flow. Always state these terms clearly on the invoice. For more tips on managing client relationships, see our guides for marketing agencies and software agencies.

Integrating Invoicing with Your Business Workflow

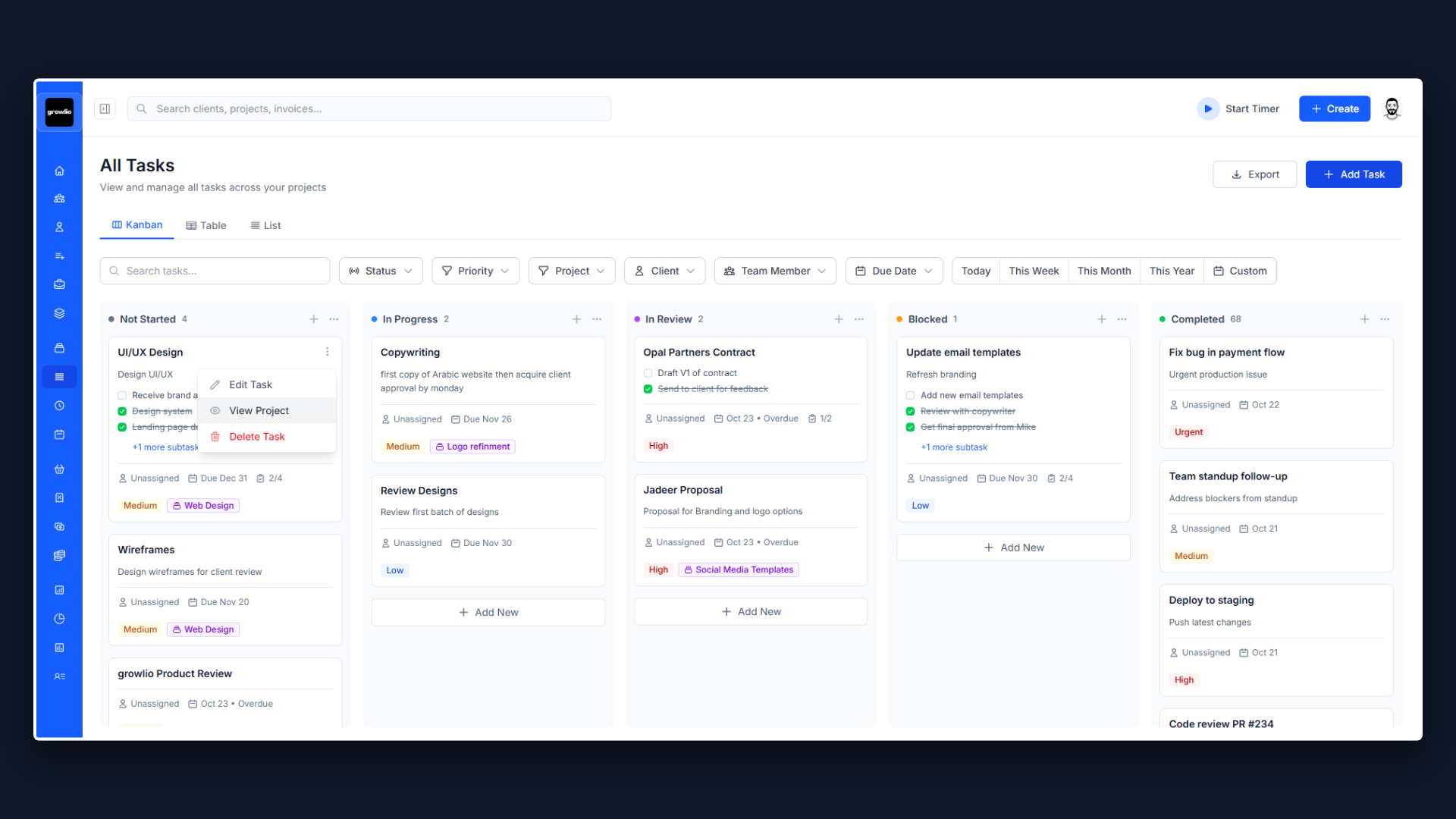

Efficient invoicing is part of a larger business process. The workflow typically includes:

- Project completion or service delivery - Mark work as complete in your project management system

- Time and expense tracking - Gather all billable hours and project costs

- Invoice generation - Create the invoice with all required details

- Review and approval - Verify accuracy before sending

- Delivery to client - Email as PDF or send through invoicing portal

- Payment tracking - Monitor invoice status and send reminders

- Recording payment - Update accounting records when paid

- Tax reporting - Include in quarterly VAT returns

Integrated business management platforms streamline this entire process, automatically moving from one step to the next without manual intervention. This reduces errors, saves time, and ensures nothing falls through the cracks. Discover how Growlio can automate your entire invoicing workflow from proposal to payment.