Complete Guide to UAE VAT Calculations in 2025

Value Added Tax (VAT) was introduced in the UAE on January 1, 2018, at a standard rate of 5%. Since then, businesses across Dubai, Abu Dhabi, and all Emirates must properly calculate, collect, and remit VAT to the Federal Tax Authority (FTA). Understanding how to accurately calculate VAT is essential for compliance, proper invoicing, and maintaining healthy cash flow. Just as proper expense management best practices help you track costs, accurate VAT calculation ensures you stay compliant while maximizing input VAT recovery.

Understanding UAE VAT

VAT is a consumption tax applied at each stage of the supply chain. In the UAE, the standard rate is 5%, which is relatively low compared to global standards (EU countries range from 17-27%). This makes the UAE an attractive business destination while still generating government revenue.

The three main VAT categories in UAE are: Standard-rated (5%) for most goods and services,Zero-rated (0%) for exports, international transport, healthcare, and education, and Exempt for residential properties and certain financial services.

How to Calculate VAT: Step-by-Step

Adding VAT to a Price

When you need to add VAT to a net price (the amount before tax):

- Take the original amount (e.g., AED 1,000)

- Calculate 5% of that amount: 1,000 × 0.05 = AED 50

- Add the VAT to the original: 1,000 + 50 = AED 1,050

- Or simply multiply by 1.05: 1,000 × 1.05 = AED 1,050

Quick Formula

Add VAT: Amount × 1.05 = Total with VAT

Example: AED 2,500 × 1.05 = AED 2,625

Removing VAT from a Total

When you have a gross amount (including VAT) and need to extract the VAT:

- Take the total amount (e.g., AED 1,050)

- Divide by 1.05: 1,050 ÷ 1.05 = AED 1,000 (net amount)

- Subtract to find VAT: 1,050 - 1,000 = AED 50

Quick Formula

Remove VAT: Total ÷ 1.05 = Amount excluding VAT

Example: AED 5,250 ÷ 1.05 = AED 5,000 (VAT = AED 250)

VAT Registration Requirements

Not all businesses in UAE must register for VAT. The requirements depend on your annual taxable supplies and imports:

- Mandatory registration: Annual revenue exceeds AED 375,000

- Voluntary registration: Annual revenue between AED 187,500 and AED 375,000

- Cannot register: Annual revenue below AED 187,500

Once registered, you receive a Tax Registration Number (TRN) which must appear on all tax invoices. You're required to file VAT returns and pay tax to the FTA, typically quarterly or monthly depending on your turnover. Setting up your business correctly from day one is crucial—learn about business setup costs in UAE to understand all compliance requirements.

Input VAT vs Output VAT

Understanding the difference between input and output VAT is critical for managing cash flow and VAT returns:

Output VAT is the VAT you charge to customers on your sales. This is the tax you collect on behalf of the government. For example, if you sell services worth AED 10,000, you charge AED 10,500 (including AED 500 output VAT).

Input VAT is the VAT you pay on business purchases and expenses. This is the tax you can reclaim from the FTA. If you purchase AED 5,000 worth of supplies, you pay AED 5,250 (including AED 250 input VAT that you can recover).

Net VAT Payable

Your net VAT payable to the FTA = Output VAT - Input VAT

Example: If you collected AED 10,000 output VAT and paid AED 3,000 input VAT, you owe the FTA AED 7,000.

Common VAT Scenarios for UAE Businesses

1. Invoicing Clients

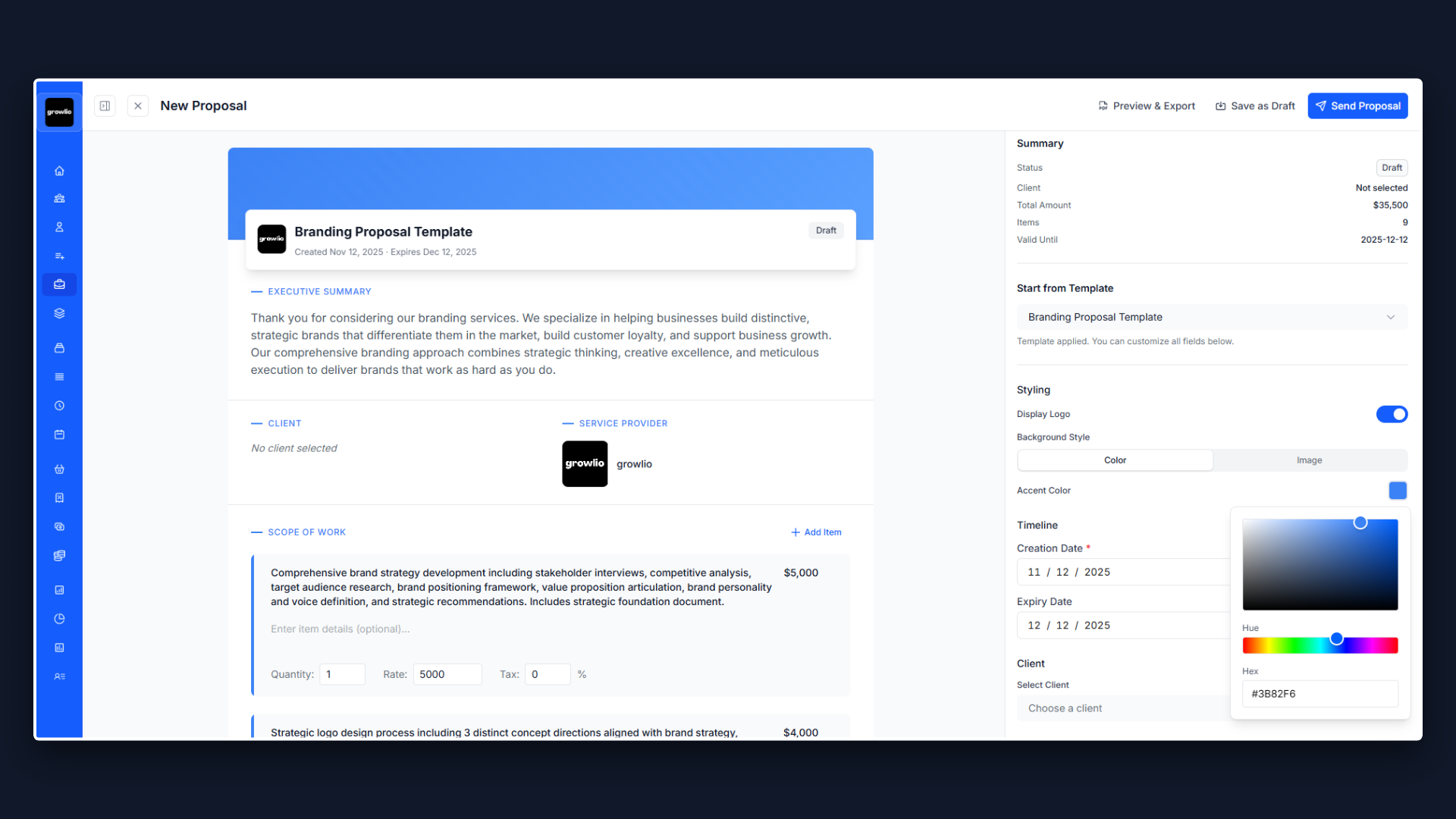

When creating invoices for clients, you must show the net amount, VAT amount (5%), and gross total separately. Your tax invoice must include your TRN, customer details, invoice date, and a clear VAT breakdown. Proper invoicing practices ensure faster payment and VAT compliance.

2. Receiving Supplier Invoices

When you receive invoices from suppliers, the total includes VAT. You need to extract the input VAT for your VAT return. Always verify that the supplier's invoice includes their TRN and properly shows the VAT breakdown. Track these expenses systematically using time and expense tracking tools to ensure accurate VAT recovery.

3. E-commerce and Online Sales

For online businesses, VAT applies based on where the customer is located. Sales to UAE customers are subject to 5% VAT, while exports are typically zero-rated. You must maintain proper records of customer locations and apply VAT correctly based on the place of supply rules.

4. International Transactions

Exports of goods from UAE are zero-rated (0% VAT), meaning you don't charge VAT but can still reclaim input VAT. Imports are subject to 5% VAT at customs, which you can reclaim if VAT registered. Cross-border services follow specific place of supply rules determined by the FTA.

VAT Compliance Best Practices

- Maintain Detailed Records: Keep all invoices, receipts, and VAT-related documents for at least 5 years. The FTA can audit your records and proper documentation protects you from penalties.

- Issue Compliant Tax Invoices: Ensure every invoice includes all required fields: TRN, date, sequential number, buyer details, description, net amount, VAT amount, and gross total.

- File Returns On Time: Submit your VAT returns by the 28th of the month following the tax period. Late filing incurs penalties of AED 1,000 for the first offense, AED 2,000 for the second within 24 months.

- Separate Business and Personal: Only reclaim VAT on legitimate business expenses. Personal expenses are not eligible for input VAT recovery and can trigger FTA scrutiny.

- Use Accounting Software: Manual VAT tracking is error-prone and time-consuming. Modern platforms automate VAT calculations, track input and output VAT, and generate FTA-compliant reports. Effective process automation reduces compliance risk and saves hours every month.

Common VAT Calculation Mistakes

Mistake 1: Rounding Errors

Always calculate VAT on the total invoice amount, not on individual line items. Rounding each line can lead to discrepancies. The correct approach: sum all line items, then calculate 5% VAT on the total.

Mistake 2: Incorrect Reverse Calculation

Don't calculate VAT by simply multiplying the gross amount by 5%. This gives you 5% of the total, not the actual VAT component. Always divide by 1.05 to extract the net amount, then subtract to find VAT.

Mistake 3: Mixing VAT Rates

When invoices include both standard-rated (5%) and zero-rated (0%) items, calculate each section separately. Don't apply 5% to the entire invoice if some items are zero-rated.

Mistake 4: Forgetting Decimal Precision

Always use at least 2 decimal places for currency. Rounding too early in calculations can compound errors across multiple transactions, leading to incorrect VAT returns.

VAT Penalties and Fines

The FTA enforces VAT compliance strictly with a tiered penalty system:

- Late Filing: AED 1,000 (first time), AED 2,000 (repeat within 24 months)

- Late Payment: 2% of unpaid tax if delay is 7 days or less, then 4% for day 8-13, plus 1% daily penalty (max 300%)

- Failure to Register: AED 20,000 penalty

- Tax Evasion: Up to AED 500,000 and possible imprisonment

- Inaccurate Returns: 50% of tax difference if underreporting is deliberate

These penalties underscore the importance of accurate VAT calculation and timely compliance. Setting up proper business processes from day one prevents costly mistakes and ensures smooth FTA interactions.

Tools and Automation for VAT Management

Modern businesses can't afford manual VAT tracking. The best approach combines:

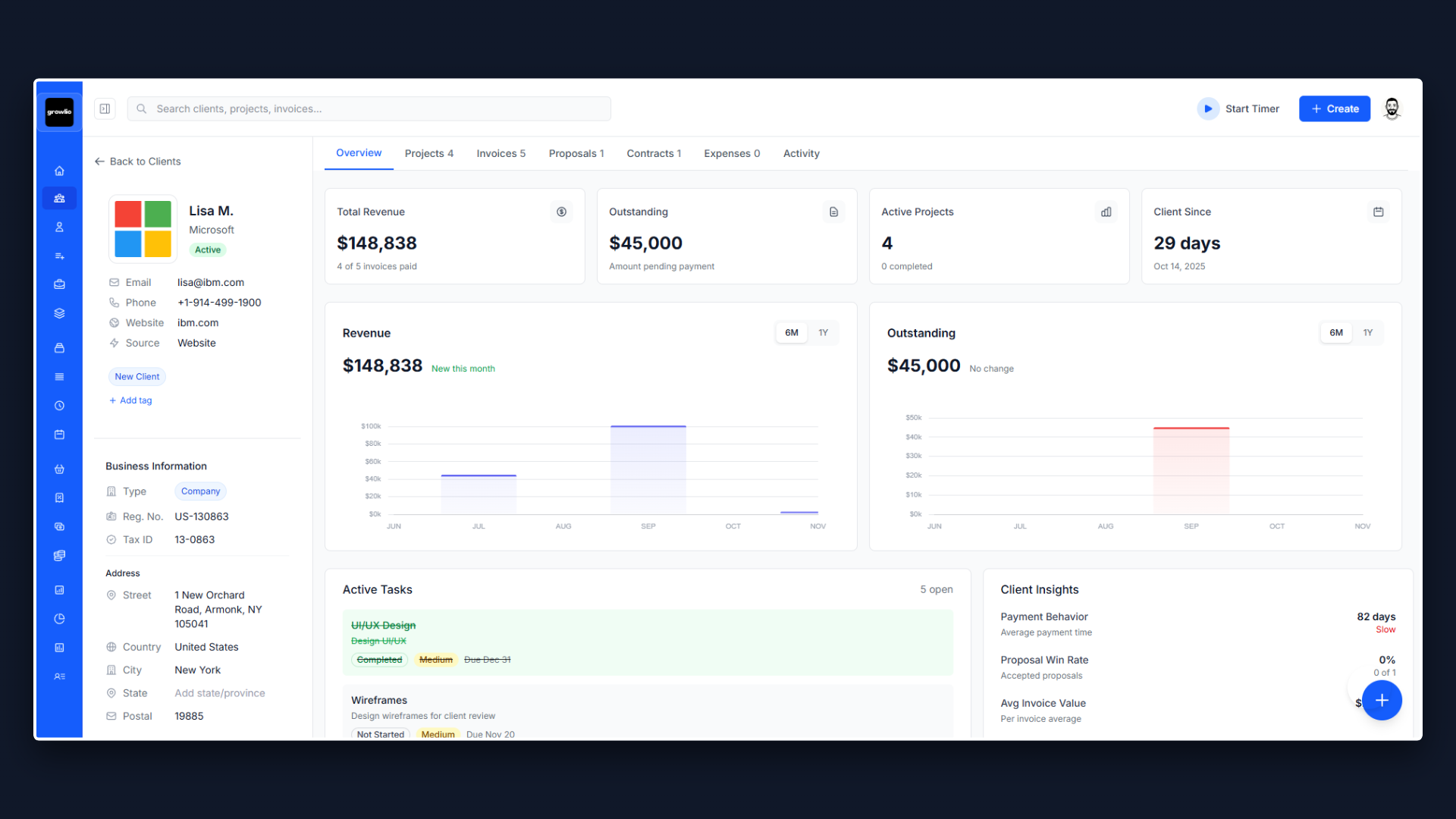

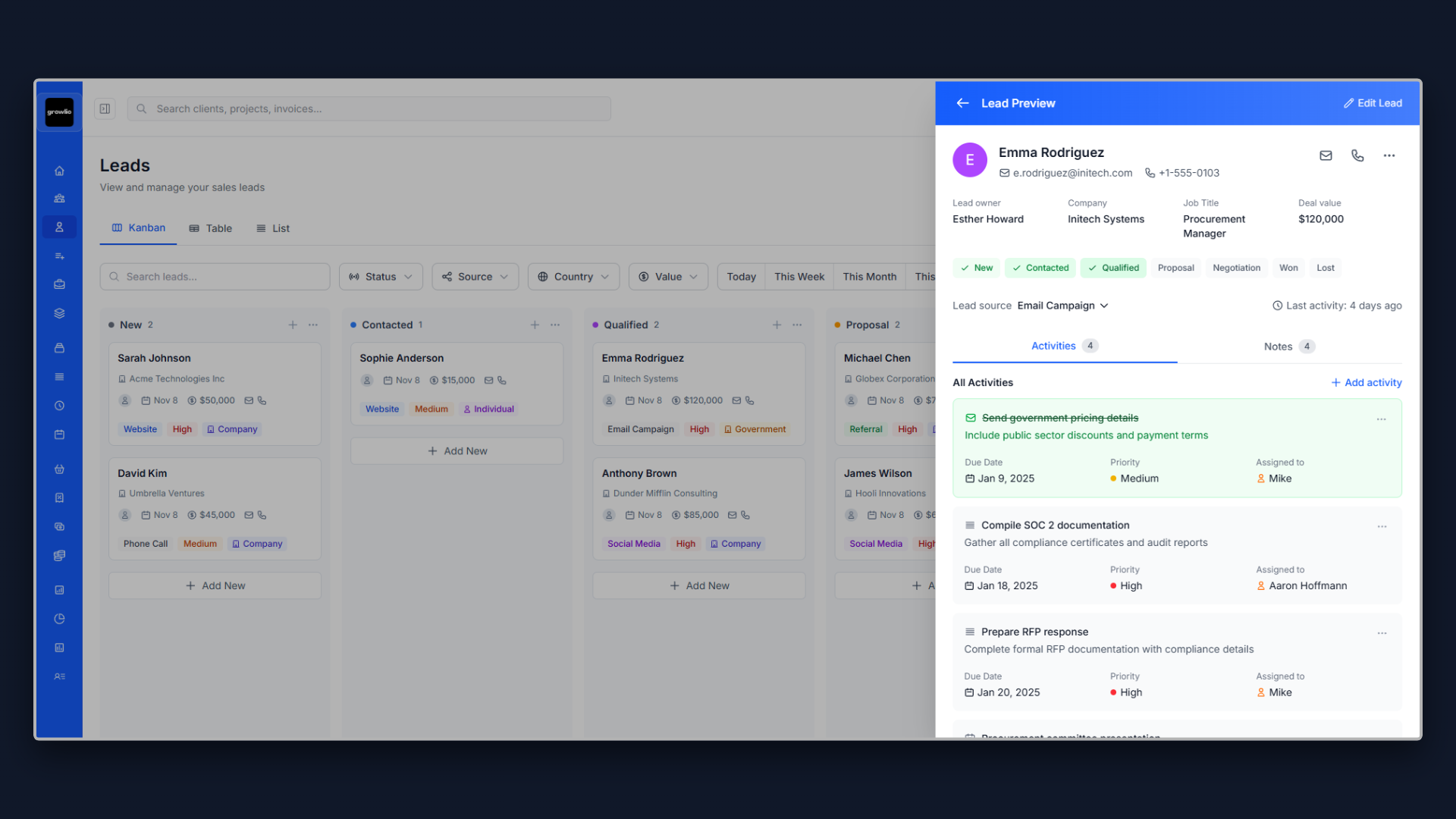

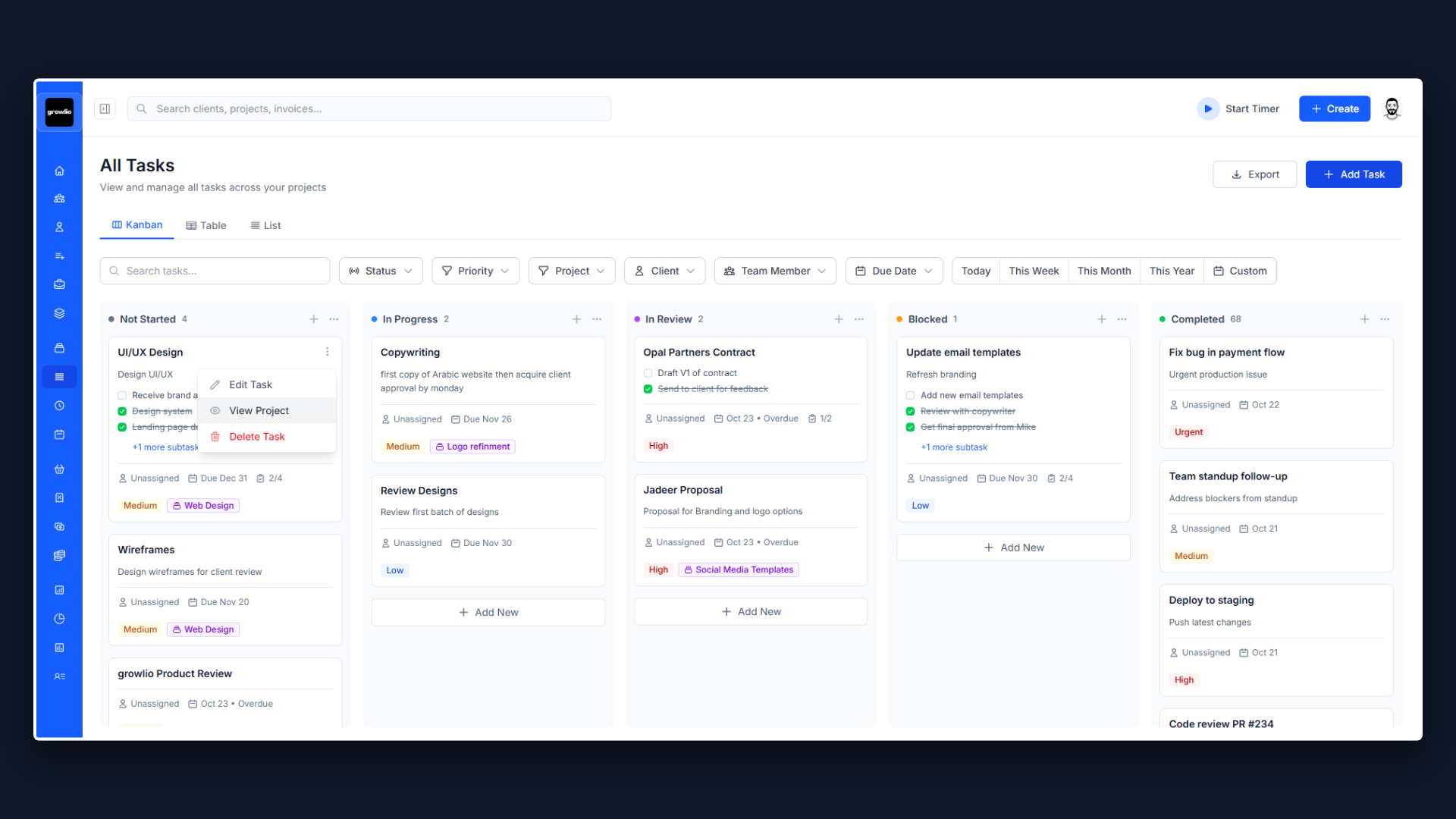

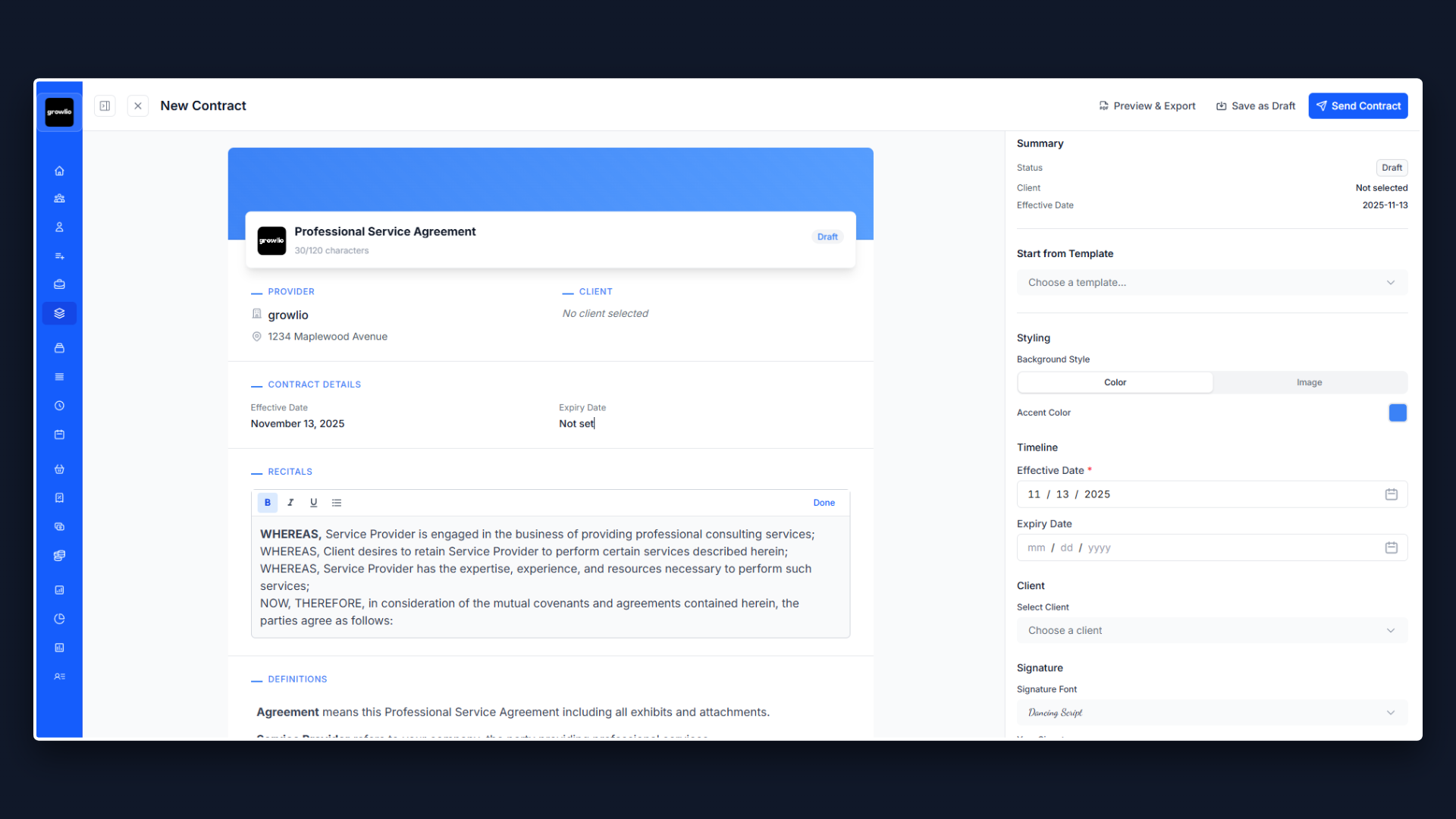

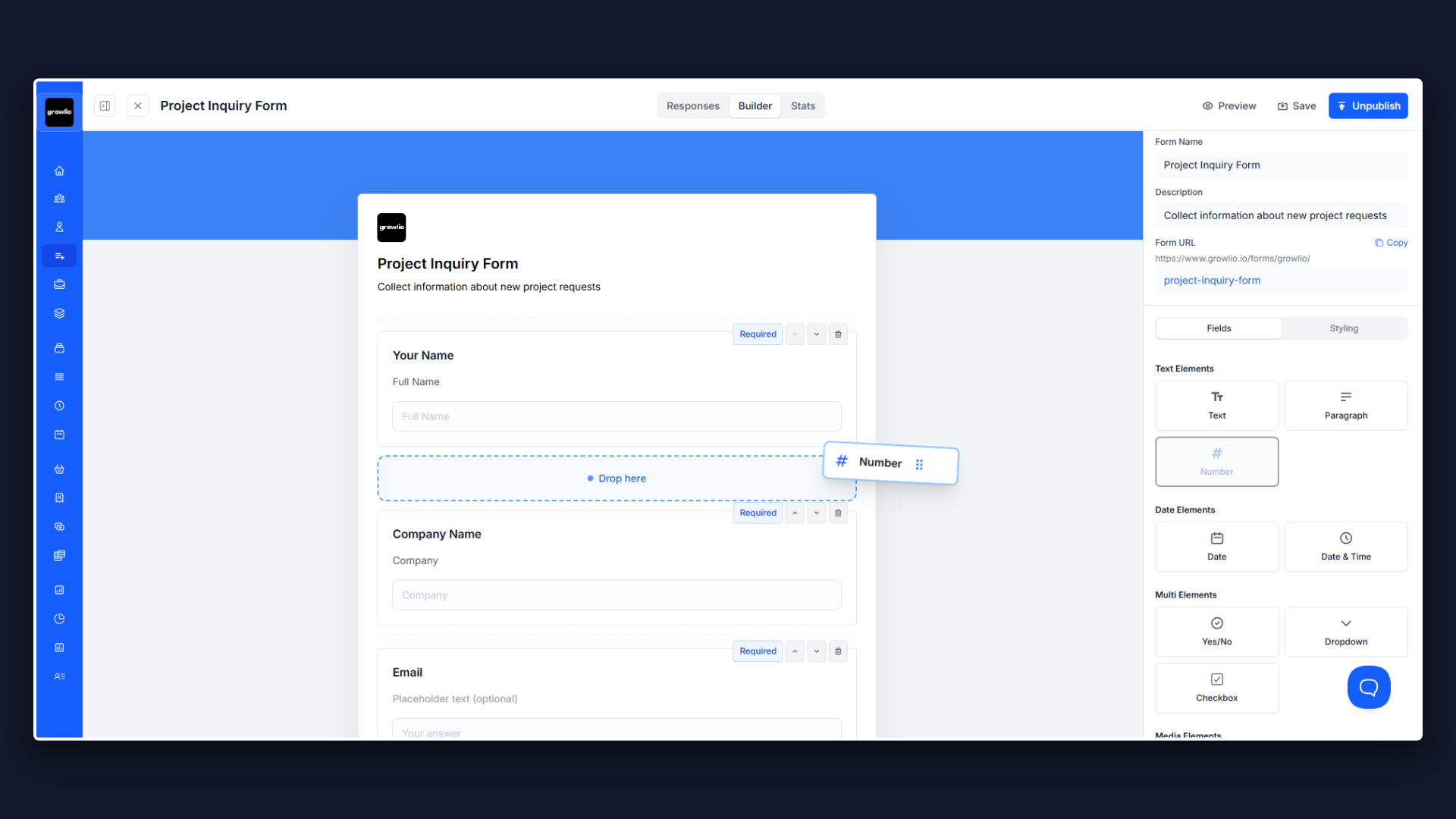

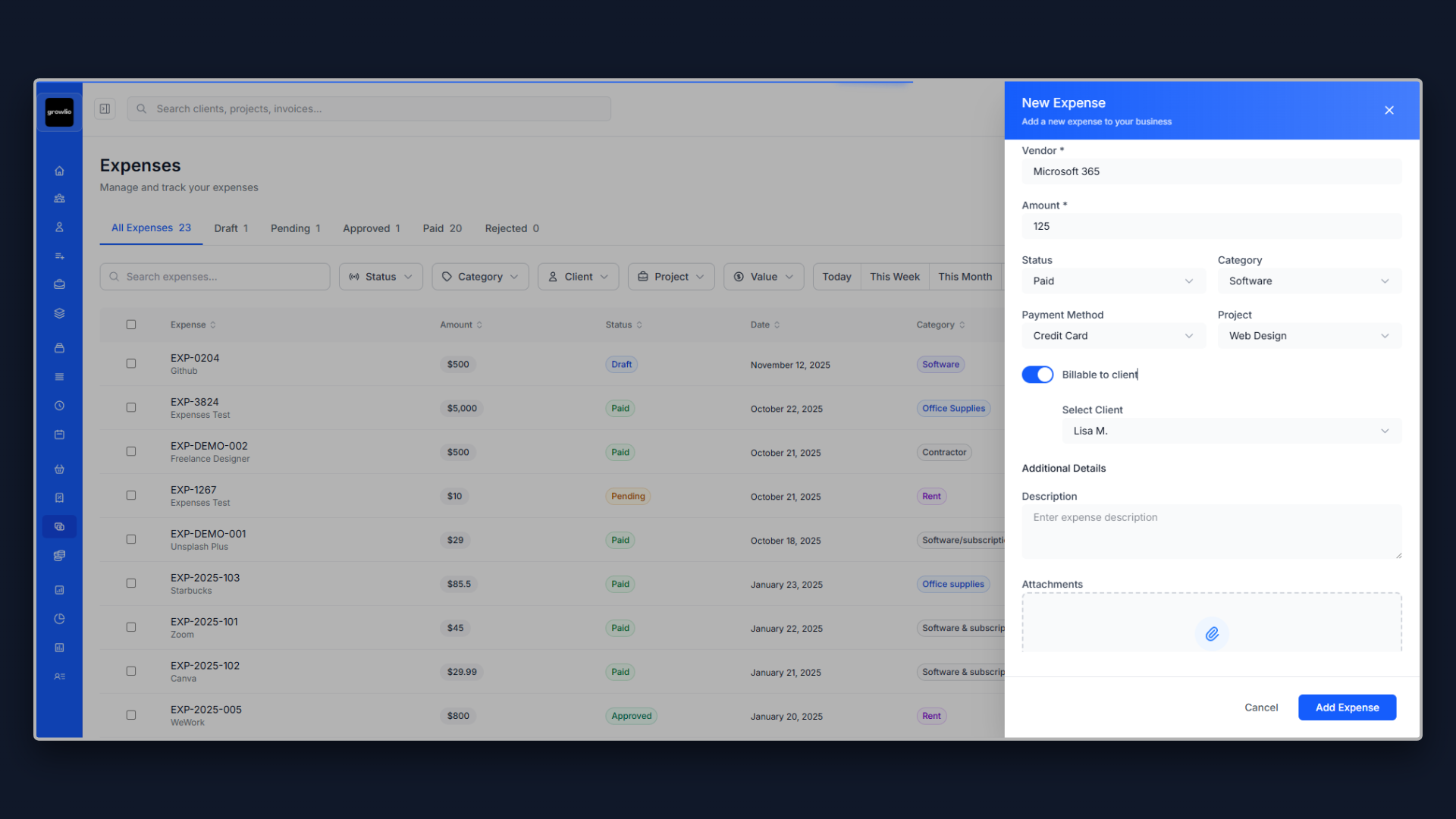

- Automated invoicing systems that calculate VAT on every invoice and track payment status

- Expense tracking that captures input VAT from every business purchase

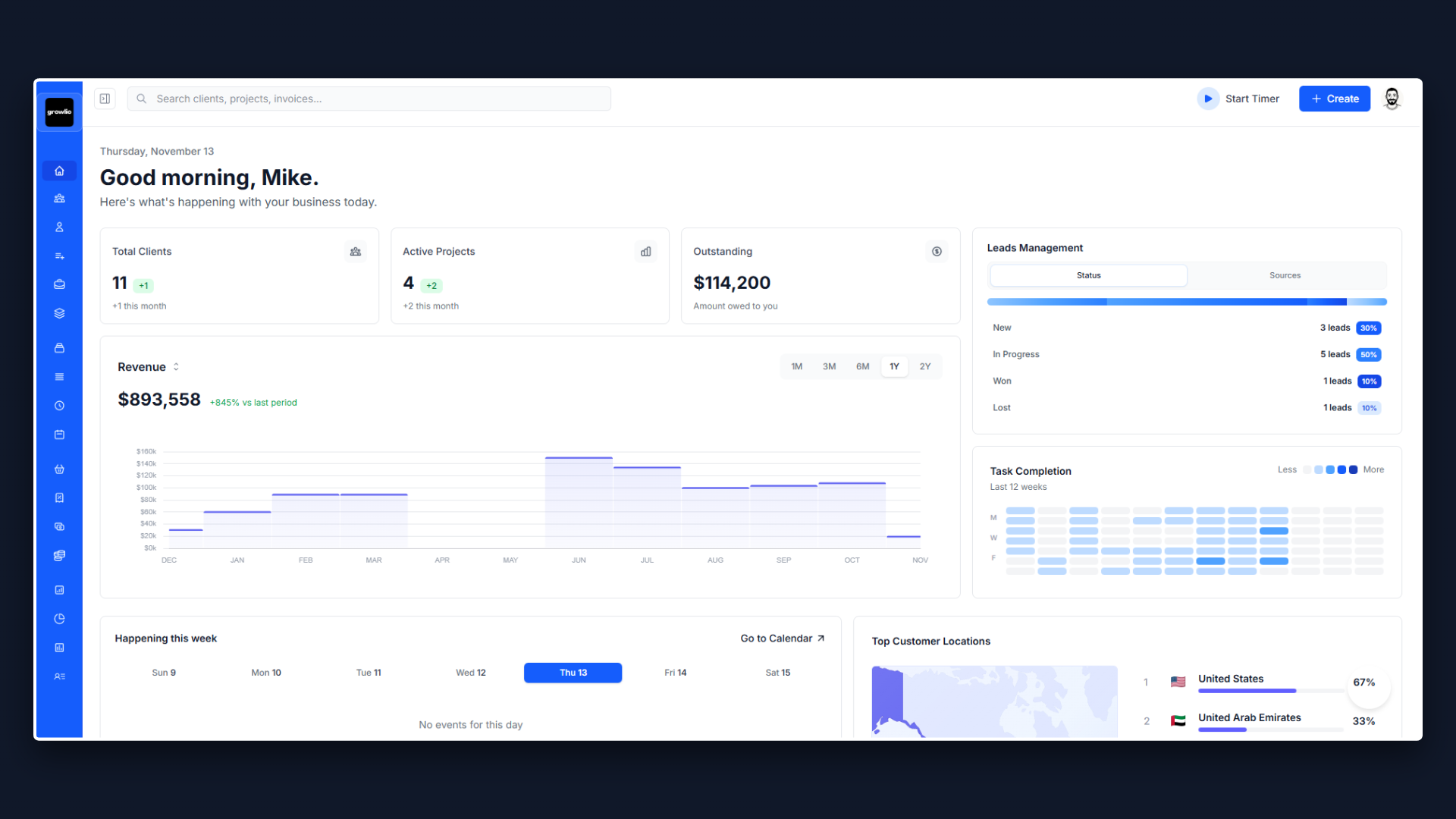

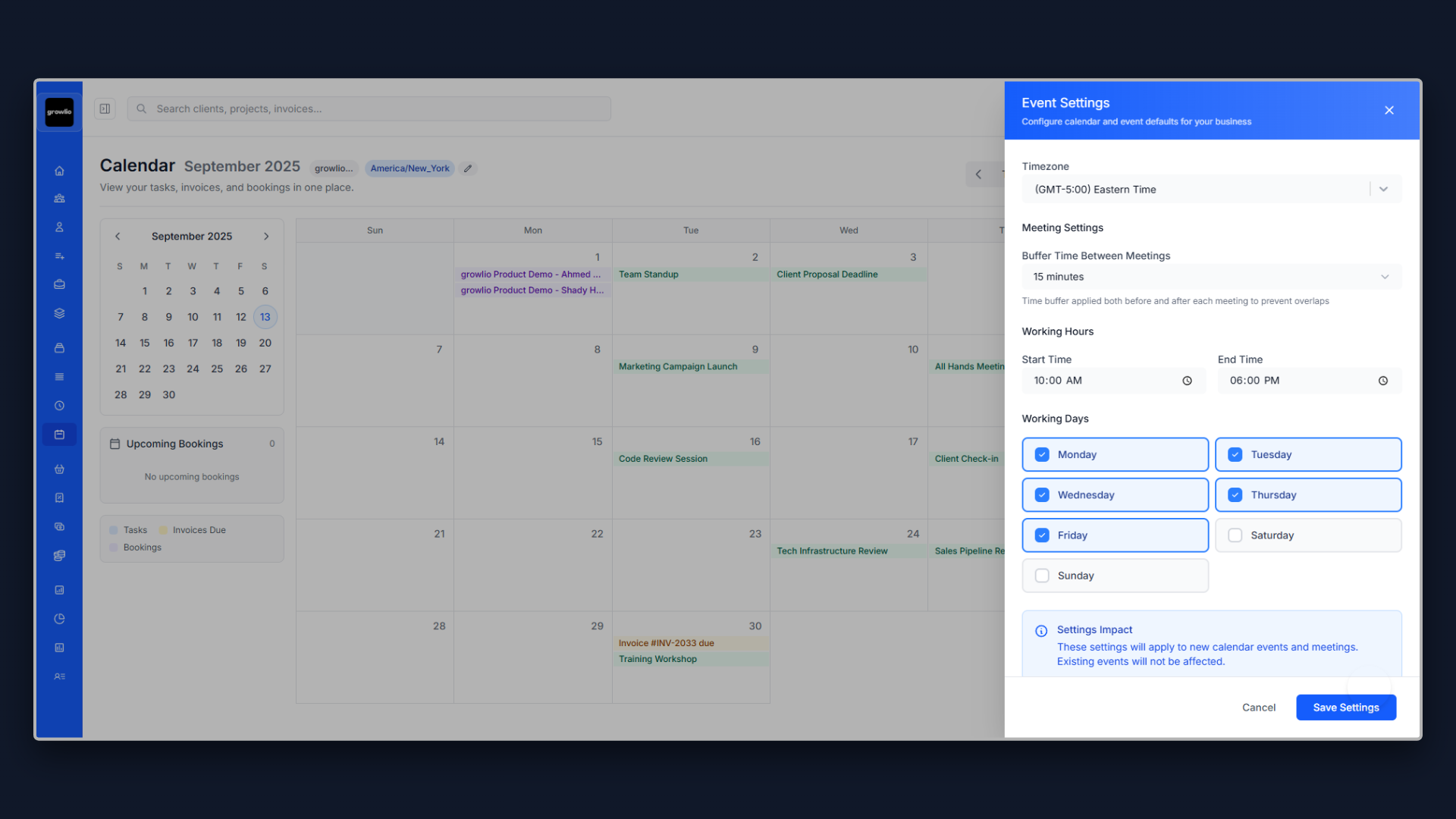

- Real-time dashboards showing VAT payable, input VAT recoverable, and filing deadlines

- FTA-compliant reporting that generates VAT returns in the exact format required

- Document storage maintaining all invoices and receipts for the mandatory 5-year period

Platforms like Growlio integrate all these features, automatically calculating VAT on invoices, tracking input VAT on expenses, and generating comprehensive VAT reports. This eliminates manual calculations, reduces errors, and ensures compliance while saving hours every month.

Pro Tip: Monthly Reconciliation

Don't wait until your VAT return deadline to reconcile accounts. Perform monthly VAT reconciliation to catch errors early, track cash flow accurately, and avoid last-minute panic. Set aside the expected VAT payment in a separate account to ensure funds are available when filing. Learn about cash flow management to optimize your VAT payment timing.

Industry-Specific VAT Considerations

Real Estate

Commercial property sales and leases are subject to 5% VAT. Residential property sales are exempt, but first-supply within 3 years of completion is zero-rated. Residential rentals are exempt from VAT.

Healthcare and Education

Most healthcare and education services are zero-rated, meaning providers don't charge VAT to patients/students but can still reclaim input VAT on business expenses. This improves affordability while maintaining VAT recovery rights.

Financial Services

Many financial services are exempt from VAT, including interest, life insurance, and share trading. However, financial advisory and asset management services are typically standard-rated at 5%.

Hospitality and Tourism

Hotels, restaurants, and tourism services are standard-rated at 5%. International transport is zero-rated, while domestic transport is standard-rated. Tour operators must carefully track which components are zero-rated versus standard-rated.