Chasing down payments is one of the most draining parts of being a consultant. You’ve delivered incredible value, solved a client's problem, and now you have to play accountant. The good news? You can dramatically speed up how fast you get paid with one simple fix: a better invoice. A professional invoice template for consulting is more than just a request for money—it’s a final piece of communication that clearly outlines your value and makes it dead simple for your client to pay you.

Stop Chasing Payments, Start Getting Paid

We've all been there. You wrap up a major project, feeling great about the results, only to spend the next 30 days sending polite-but-firm "just checking in" emails. This cycle is exhausting and pulls your focus away from what you should be doing: winning your next project. More often than not, the problem starts with a vague or confusing invoice that leaves your client scratching their head.

A well-designed invoice template is your best weapon against this. It shifts your billing from a frustrating chore into a smooth, professional process that works every time.

Mini-Case Study: The Two-Tweak Invoice Fix

I once worked with a financial services firm whose payments were, on average, 22 days late. A quick look at their invoice revealed the problem: there was no clear due date, and it didn't list the payment methods they accepted.

We made two simple, actionable changes:

- Added a bold "Due in 15 days" at the top.

- Included a direct link for credit card payments.

The result? Their average payment time dropped from 22 days to just four days. By removing the guesswork, we made paying the bill the easiest thing for their clients to do.

Of course, a solid invoice is just one piece of the puzzle. You also need to be prepared for payment disputes, which can claw back your hard-earned revenue. Digging into a complete guide to chargebacks in professional services is a smart move for any consultant. It's also worth understanding the nuances between billing and invoicing to make sure all your financial communication is crystal clear. You can learn more about that here: https://www.growlio.io/blog/billing-vs-invoicing

Pro tip for advanced users: Your invoice is a branding document. Adding your logo and using your brand colors reinforces your professional image. But take it a step further: add a short, personalized note like, “Jane, it was a pleasure collaborating with your team on the Q3 launch. Looking forward to our next project!” It’s a small touch that builds loyalty and makes the payment process feel less transactional.

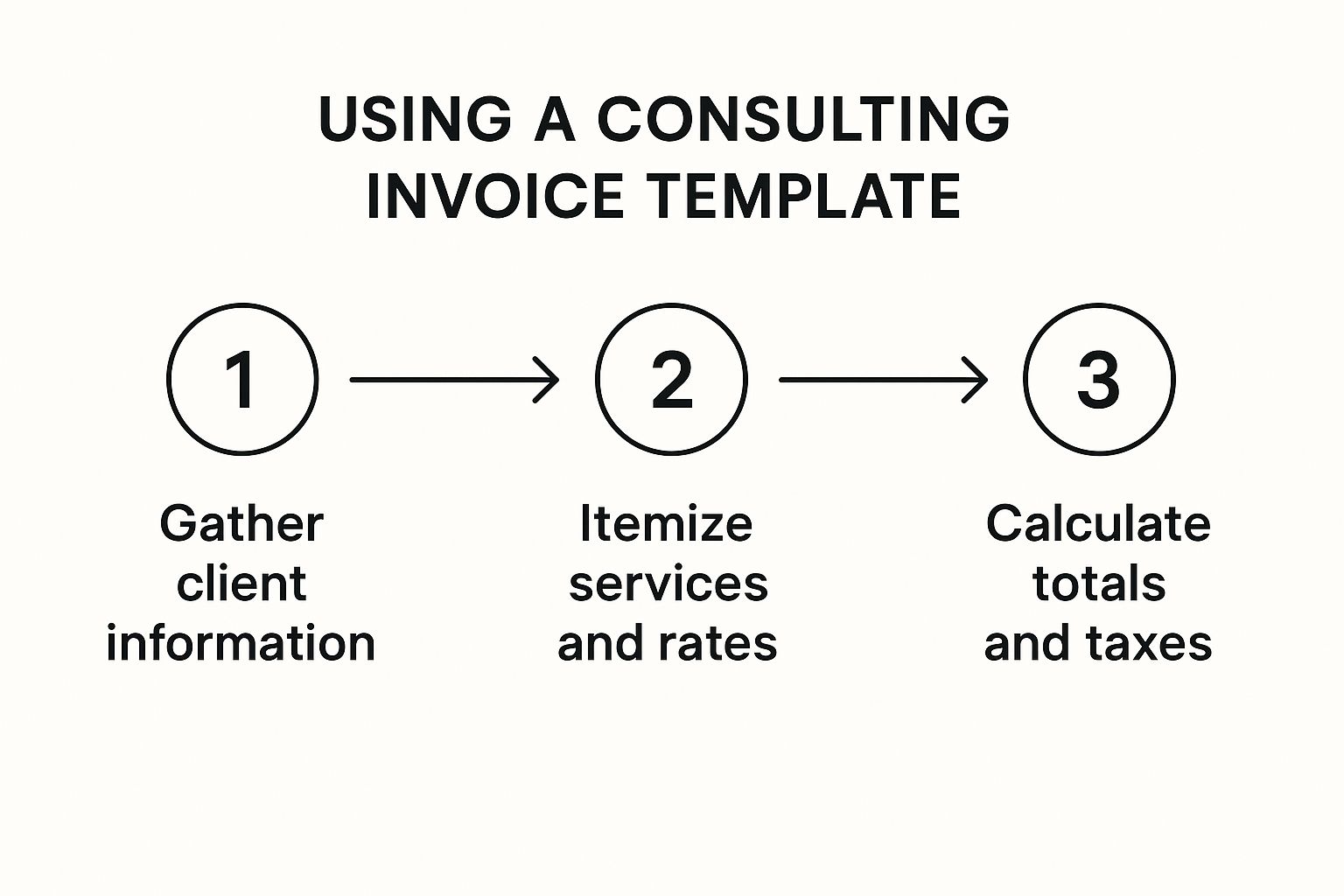

Assembling Your Professional Consulting Invoice: A Step-by-Step Guide

So, you’ve done the work, delivered the value, and now it’s time to get paid. But staring at a blank page can be a real momentum killer. Let's break down how to build a clear, complete, and professional invoice from the ground up, step by step.

A well-structured template turns what could be a tedious task into a simple, repeatable process. This means fewer errors, less time spent on admin, and faster payments.

The Anatomy of a Perfect Invoice

Every professional invoice needs a core set of elements to be processed without a hitch. Missing just one can lead to confusion and frustrating payment delays. Here’s a checklist of the non-negotiable fields your consulting invoice template must have.

Table: Essential Fields for a Professional Consulting Invoice

| Invoice Element | Its Purpose | Action Step |

|---|---|---|

| Your Business Information | Identifies you as the service provider (Name, Address, Contact Info). | Add your logo for instant brand recognition and a more professional look. |

| Client’s Information | Clearly identifies who the invoice is for (Company Name, Contact Person, Address). | Double-check you have the correct legal entity name and address for their accounting team. |

| Unique Invoice Number | A crucial identifier for tracking payments and for both parties' bookkeeping. | Use a simple sequential system (e.g., 001, 002) or one that includes the year (e.g., 2024-001). |

| Invoice Date & Due Date | Specifies when the invoice was issued and when payment is expected. | Be explicit. Use terms like "Due on Receipt" or "Net 30" and specify the exact date. |

| Itemized List of Services | Provides a detailed breakdown of the work performed, justifying the total cost. | Be descriptive but concise. Vague line items are the #1 cause of payment questions. |

| Rates, Quantities, & Subtotals | Shows how you calculated the charges (e.g., hours x rate, project fee). | Transparency is key. This section builds trust and eliminates the need for clarification. |

| Total Amount Due | The final, bolded number that clearly states the total payment required. | Make this the most prominent financial figure on the page. No one should have to hunt for it. |

| Payment Terms & Instructions | Explains how to pay you (e.g., bank transfer details, online payment link). | Include all necessary details like account numbers, SWIFT/BIC codes, or a direct link to a payment portal. |

Step-by-Step: How to Clearly List Your Services

The "services rendered" section is where the rubber meets the road. This is your opportunity to clearly communicate the value you provided. Your billing model dictates how you structure this. Here’s how to do it:

- For Hourly Billing: List the specific task, the number of hours you spent, and your hourly rate. For example:

Q2 Competitor Analysis & Reporting - 12.5 hours @ $200/hr.This level of detail builds trust. - For Project-Based Billing: Break the project into major phases or key deliverables. Tie each line item to a tangible outcome, like:

Phase 2: Go-to-Market Strategy Development. - For Retainer Billing: State the service period and what the retainer covers. For instance:

Monthly SEO & Content Consulting Retainer for April 2024.

How you present this information matters. For a deeper look at which model fits your business best, our guide on consulting pricing strategies is a great resource.

A consultant I know used to bill a flat project fee as a single line: "Strategic Consulting - $20,000." He was constantly fielding calls from clients asking for a breakdown. He switched to itemizing deliverables—"Market Opportunity Assessment," "Financial Modeling," "3-Year Growth Plan"—and the questions vanished. Even better, his average payment time sped up by nearly 30%.

An Actionable Tip for Working With Larger Clients

If you’re working with bigger companies, you must add a field for a Purchase Order (PO) Number or Project Code to your template. Many corporate accounting departments simply cannot process an invoice without it. Ask for this upfront and include it prominently on your invoice to remove a massive administrative roadblock.

Tailoring Your Invoice to Different Billing Models

Your invoice template for consulting shouldn't be a rigid, one-size-fits-all document. It’s a flexible framework you can quickly adapt to how you charge. Tailoring your invoice to the specific billing model saves time and presents your work with professional clarity—the secret to getting paid quickly.

Step-by-Step: Matching Your Invoice to Your Pricing

The real art is in how you itemize your services. Each billing style tells a different story about the value you provided. Here are step-by-step instructions for each:

Step 1: Hourly Billing Invoice: Create clear columns for the date, task description, hours worked, and your hourly rate. This detailed breakdown builds trust and justifies every dollar. UI Call-out: In growlio, you can automatically import tracked time directly into an invoice to eliminate manual entry.

Step 2: Project-Based Fee Invoice: Shift the focus from time spent to results delivered. Your line items should directly mirror the key deliverables from your proposal, like "Phase 1: Brand Strategy Framework" or "Final Delivery: E-commerce Website Launch."

Step 3: Retainer Invoice: Keep it simple. Clearly state the retainer period (e.g., "Monthly Marketing Consulting Retainer: June 2024") and briefly list the core services included. UI Call-out: Use the 'recurring invoice' feature in growlio to automate this entire process for retainer clients.

Real-World Use Case: Value-Based Billing in Action

I know a management consultant who helped a client restructure their sales team, resulting in a $250,000 jump in quarterly revenue. Instead of sending an invoice with a long list of hours, she kept it simple. The line item read: "Sales Team Restructuring & Performance Optimization."

But here's the brilliant part. Underneath, she added a short, powerful note: "Project fee tied to achieving a 15% uplift in sales pipeline efficiency, which generated an additional $250k in Q3 revenue."

That single sentence reframed her $30,000 fee from an expense into an incredible investment. The client paid it within a week, no questions asked.

It's crucial for your invoice to accommodate these varied billing models. Recent data highlights that while many consultants charge hourly, those using value-based pricing report higher project values. Over half of value-based billers charge more than $10,000 per project, compared to just 39% of those billing hourly. You can learn more from the latest consulting industry statistics on ConsultingSuccess.com.

And don't forget, no matter which model you use, payment processing fees can take a bite out of your earnings. It’s always a good idea to see what you'll actually take home by using a handy Stripe fee calculator before you hit send.

A Real-World Invoice Transformation

Are you tired of clients nickel-and-diming every line item on your hourly invoices? The key is to stop selling your time and start selling outcomes. When you shift your invoice language from tasks to value, those tedious conversations disappear, and you get paid faster.

Let’s look at a marketing consultant stuck in this exact loop. Her original invoice was basically a glorified timesheet, listing things like "Social media content creation - 15 hours." Clients constantly pushed back, questioning how every minute was spent.

From Tasks Completed to Value Delivered

She knew something had to change, so she pivoted to a value-based model. This meant completely rethinking her invoice template for consulting. Instead of tracking hours, her new invoice focused on the direct business impact her work delivered. Here’s a snapshot of what her new-and-improved invoice looked like.

See the difference? The language completely shifted. Gone were the hourly tasks, replaced with powerful, outcome-focused line items like "Lead Generation System Implemented" and "Content Strategy Delivering 25% MQL Growth."

This isn't just clever wording; it's a strategic business decision. The U.S. management consulting market is projected to hit $168.56 billion by 2030, driven by the move toward outcome-based pricing. Clients want tangible results, and this model ties your fees directly to the value you create. You can discover valuable insights about the consulting market's growth to see why this is happening.

The change had a massive impact on the consultant's business. By framing her $15,000 fee as an investment that produced a clear return, the client immediately saw the incredible ROI. The result? They paid the invoice a full week ahead of schedule.

Pro tip for advanced users: When you build a value-based invoice, add a brief, one-sentence "Impact Statement" right below the main line item. For instance, under "New Client Onboarding Process," you could add: “Reduced client churn by 18% in the first quarter.” This tiny addition powerfully reinforces the value you delivered and makes your fee feel like a steal.

This consultant's story gives you a clear blueprint for transforming your own billing. You can start building your professional, value-driven invoice in minutes with a free growlio.io account.

Pro Tips for Making Your Invoicing Effortless

Does "billing day" fill you with dread? If you’re still hunting for spreadsheets and manually attaching PDFs to emails, you're losing valuable time. Here are some actionable steps to automate the process.

- Step 1: Use Recurring Invoices: For retainer clients, set up recurring invoices in a tool like growlio.io. This frees up hours every month and ensures you never forget to bill.

- Step 2: Integrate Payment Gateways: Connect your invoice directly to payment processors like Stripe or PayPal. A "Pay Now" button is the single best way to get paid faster.

- Step 3: Automate Reminders: Set up gentle, automated follow-up emails for overdue invoices. This takes the emotion out of chasing payments and keeps you professional.

Beyond just a solid template, dedicated software can really change the game. These platforms do more than just send an invoice; they help you manage client details and track payments, taking a ton of the manual work off your plate. If you're curious, you can check out some of the top invoicing tools for freelancers to find one that clicks with your workflow.

Invoicing in a Global Marketplace

As your business expands, your invoice template for consulting needs to address a few new challenges.

- Currency Conversion: Make sure you invoice in the currency agreed upon in your contract. Note the exchange rate used if you're billing in their local currency.

- Global Taxes: Your invoice needs to be crystal clear about whether taxes like VAT or GST are included or are an additional charge.

- Marketplace Fees: If you find clients on global platforms, their fees (often 20-35%) will take a cut. Your invoice should show this deduction clearly so both you and your client see the gross pay versus your net earnings.

Getting these financial details right is absolutely crucial for staying profitable. To dig deeper into this, have a look at our guide on https://www.growlio.io/blog/expense-management-best-practices.

Ditch the Spreadsheets and Get Paid Faster

If you're still wrestling with manual templates and spreadsheets every month, it's time for an upgrade. Automating your billing is the next logical step to scaling your consulting business. Using a dedicated platform gets you out of the administrative weeds and back to focusing on what you're actually paid for: delivering incredible value.

A marketing consultant I know integrated her invoicing with her project workflow. The result? She got back over five hours a month that used to be lost to admin tasks. It also gave her a much clearer picture of her project financials, which is a huge part of solid project management for consultants.

Pro tip for advanced users: For any clients on a retainer, set up automated recurring invoices immediately. This is a classic “set it and forget it” move that guarantees you never miss a billing cycle. It creates a predictable cash flow with practically zero effort on your part each month. In growlio.io, you can set this up in under two minutes from the 'Recurring Invoices' tab.

Common Invoicing Questions from Consultants

If you’ve ever found yourself wondering about the best way to bill for a long project, you're in good company. Here are actionable answers to common questions.

How often should I invoice for long-term projects?

For most long-term gigs, monthly invoicing is the standard. It creates a predictable payment rhythm for both you and your client. For massive projects, you might agree to invoice every two weeks or after hitting certain milestones. Actionable step: Define the billing schedule in your contract from the start. Never wait until a multi-month project is completely finished to send the first bill.

What if a client disputes an invoice?

The first rule is to keep your cool. Acknowledge their email or call right away and ask for specifics. A quick phone call can clear up a misunderstanding much faster than a long back-and-forth email thread. If the invoice is accurate, politely point back to the signed contract and the project scope you both agreed on.

A marketing consultant I know once had a client push back on an invoice, claiming there were "unapproved hours." She just calmly pulled up the shared project management board, which clearly showed the client themselves had requested the extra tasks in the comments. The dispute vanished on the spot.

Should I charge late fees?

Absolutely, but with one huge caveat: this policy must be spelled out in your contract and clearly stated on the invoice. A typical late fee is 1.5% per month on the overdue amount. You can always choose to waive it as a gesture of goodwill, but having that policy in writing gives you the necessary leverage to encourage clients to pay on time.

You've learned the exact steps to create a professional invoice that gets you paid faster. Now, it's time to put it into action. Ditch the spreadsheets and stop chasing payments for good. growlio makes it easy to create professional invoices, automate reminders, and manage your entire consulting business from one place. Start your free growlio.io account and send your first perfect invoice in minutes.