Staring at a blank proposal, completely stuck on the pricing section? It's a classic consultant's dilemma. You know what you're worth, but putting an exact dollar figure on it can feel like throwing a dart in the dark. This is the hurdle that keeps talented consultants from earning what they're truly worth.

But what if you could ditch the guesswork? Here’s a quick win: before your next client call, calculate your baseline profitable rate. This simple number is your strategic floor—the absolute minimum you need to charge to run a profitable business—and it will instantly boost your confidence when it's time to talk money.

Stop Undercharging and Start Pricing with Confidence

The fear of getting your pricing wrong is real. Price too high, and you might scare away a great client. Price too low, and you're leaving hard-earned money on the table. This is the tightrope walk that keeps many talented consultants from hitting their true earning potential. But with the right consulting pricing strategies, you can approach every proposal from a place of strength.

Let's walk through how to calculate that baseline rate right now.

The Baseline Rate Formula: A Step-by-Step Guide

This isn’t just about plucking a number out of thin air. It’s about building a solid foundation that ensures you cover your costs, account for all that crucial non-billable time, and actually hit your income goals.

- Determine Your Target Annual Salary: First, decide on the yearly income you want to earn.

- Add Your Annual Business Costs: Tally up all your overhead. Think software subscriptions (like your growlio account), marketing expenses, insurance, and any office-related costs.

- Calculate Your Total Billable Hours: A typical year has 2,080 work hours. Be realistic and subtract time for vacations, holidays, and sick days. Crucially, you also need to account for non-billable work like sales, admin, and professional development. A common rule of thumb is that about 50% of your time is non-billable, which might leave you with around 1,000 billable hours per year.

- Divide Your Total Costs by Billable Hours: The math is simple: (Target Salary + Business Costs) / Billable Hours = Your Baseline Hourly Rate.

This baseline rate is your strategic floor. From here, we can explore more sophisticated consulting pricing models that help you move beyond just trading your time for money. It's also important to grasp how you price your services versus how you actually collect payment. For a closer look at that, check out our guide on the distinction between billing vs. invoicing.

Pro Tip: The Profit Margin Multiplier

Once you have your baseline hourly rate, don't just stop there. To build a truly healthy business, multiply that rate by 1.2 to 1.5 to bake in a solid profit margin. For instance, if your baseline comes out to $100/hour, your target rate should actually be in the $120-$150/hour range. This buffer gives you breathing room for unexpected project snags and ensures your business is growing, not just getting by.

Now that you've laid a profitable foundation, you're ready to start building out your strategic pricing toolkit.

The Four Core Consulting Pricing Models Explained

Ever get that feeling you’re leaving money on the table? You know what you should be making per hour, but applying that same rate to a client with a quick question and another needing a six-month overhaul just feels wrong. It's clunky, and frankly, it's not strategic.

Ever get that feeling you’re leaving money on the table? You know what you should be making per hour, but applying that same rate to a client with a quick question and another needing a six-month overhaul just feels wrong. It's clunky, and frankly, it's not strategic.

Think of your baseline rate as your financial floor—the absolute minimum you need to stay in business. These four models are the strategic frameworks you build on top of that floor. They are different ways to package and sell your value, and picking the right one is a game-changer.

1. Hourly and Daily Rates

This is the classic "time for money" swap. It’s the most straightforward way to price your services, and it’s the one most clients instinctively understand. You’re essentially renting out your brain by the hour or by the day.

- How It Works: You track your time meticulously and bill the client for every hour or day you put into their project at a pre-agreed rate.

- Best For: Projects where the scope is a moving target, like initial discovery phases, urgent troubleshooting, or when a client wants you on-call for support.

- Pros: It’s dead simple to set up and ensures you’re paid for every minute you work.

- Cons: This model directly caps your income based on the number of hours in a day. It can also penalize you for being efficient—the better and faster you get, the less you earn for the same task.

2. Project-Based Fees

With a project-based fee, you’re not selling your time; you’re selling a specific outcome for a single, flat price. It’s like getting a fixed quote to have a new kitchen installed. The client knows exactly what they’re paying, and you know exactly what you need to deliver.

The key to making this model profitable is getting really good at scoping. You have to break the entire project down into detailed steps, accurately estimate your time for each, and then add a healthy cushion—I usually recommend 15-20%—for those inevitable curveballs.

3. Retainer Agreements

A retainer is like putting your expertise on subscription. The client pays you a set fee every month, and in return, they get ongoing access to your services or a pre-agreed amount of your time. It’s the best way to build stable, long-term relationships.

Retainers generally come in two flavors:

- Pay-for-Work: The client is pre-paying for a specific number of hours or deliverables each month.

- Pay-for-Access: This is more about availability. The client pays to have you in their corner, ready to provide strategic advice when they need it. Think of it as having a top-tier advisor on speed dial.

For a consultant, retainers are golden. They create predictable, recurring revenue, which makes managing your cash flow and planning for the future so much easier.

4. Value-Based Pricing

This is the big one. It's the most advanced and, when done right, the most profitable pricing model. With value-based pricing, your fee has nothing to do with your hours or your deliverables. It’s tied directly to the economic value you create for your client.

Think of it this way: you’re not charging for the map; you’re charging for a share of the treasure you help them find.

This isn't for the faint of heart. It requires a deep dive into the client's business, a solid understanding of their numbers, and the confidence to quantify the financial upside of your work. The U.S. management consulting market has ballooned to an estimated $404.1 billion, largely because businesses are hungry for consultants who deliver measurable financial results. The growth in this sector shows just how much demand there is for value over hours.

Pro Tip: The Hybrid Pricing Approach

Remember, you don't have to choose just one model and stick with it forever. The most successful consultants often use a hybrid approach.

For instance, you could start with a fixed project-based fee for a major implementation, like migrating a CRM system. Once the heavy lifting is done, you transition the client to a monthly retainer for ongoing support, training, and optimization. This gives the client a clear, upfront cost for the big project while securing you stable, recurring revenue for the long-term relationship.

To help you see how these stack up, here’s a quick comparison.

Consulting Pricing Models At a Glance

This table breaks down the four core models to help you decide which one best fits your next project.

| Pricing Model | How It Works | Best For... | Key Benefit |

|---|---|---|---|

| Hourly/Daily | You bill for each hour or day of work. | Unclear scopes, on-call support, initial discovery. | Simple to calculate and guarantees payment for all time spent. |

| Project-Based | You charge a single, flat fee for a defined project. | Clearly defined projects with specific deliverables (e.g., a website, a marketing plan). | Provides budget certainty for the client and rewards your efficiency. |

| Retainer | A recurring monthly fee for ongoing access or a set amount of work. | Long-term relationships, ongoing support, and strategic advisory. | Creates predictable, stable monthly revenue for your business. |

| Value-Based | Your fee is a percentage of the financial value you create for the client. | Projects with a clear, quantifiable ROI (e.g., increasing sales, reducing costs). | Highest earning potential; directly links your fee to client success. |

Each model has its place, and knowing when to use each one is what separates amateur consultants from seasoned pros.

By mastering these four models, you have a versatile toolkit that lets you move beyond a rigid, one-size-fits-all approach. You can now confidently pick the pricing structure that works best for the project, the client, and—most importantly—your business.

How to Implement Project and Retainer Pricing

We’ve all been there. You quote a fixed project fee, feeling good about it, only to watch the work slowly balloon into a monster that eats up your time and profit. It's a classic consultant's nightmare. On the flip side, maybe you've thought about a retainer, but trying to define a fair scope for an entire month feels like trying to nail Jell-O to a wall.

That fear—the fear of scope creep—is what keeps so many of us stuck in the hourly trap. But with a clear, step-by-step process, you can confidently build and sell project and retainer deals that your clients will love and that will actually be profitable for you.

Setting Up a Profitable Project-Based Fee

The whole point of project-based pricing is to sell a result, not your time. Getting this right comes down to one critical skill: scoping. If you scope a project poorly, you're signing up for lost profits and a headache. But when you get it right? It's a beautiful thing for both you and your client.

Here’s the step-by-step process to nail it every time:

- Define Deliverables with Extreme Clarity: What is the client actually getting? Be specific. Don't just say "a new brand identity." Instead, promise "a complete brand guidelines PDF with primary and secondary logos, a full color palette, and typography rules."

- Break It Down into Phases and Tasks: Deconstruct the entire project into logical chunks. For a website redesign, that could mean a "Discovery Phase," "Design Phase," "Development Phase," and "Launch Phase," each with its own list of smaller tasks.

- Estimate Your Time (Honestly): Go through every single task and assign an hour estimate. Pull from past projects and be brutally honest with yourself. When in doubt, round up.

- Build in a Contingency Buffer: Projects rarely go exactly as planned. Add a 15-20% contingency cushion to your total estimated hours. This is your safety net for extra client requests or unexpected tech glitches.

- Calculate Your Price: This is the easy part. Multiply your total hours (including the buffer) by your target hourly rate. That final number is your fixed project fee. You can build this entire scope and fee structure right inside a growlio proposal.

Structuring a Sustainable Retainer Agreement

For consultants, retainers are the holy grail. They provide that sweet, predictable, recurring revenue we all crave. The trick is to structure the agreement so the client constantly sees the value you're providing, so they never have to wonder what they're paying for.

Your mission is to clearly define the ongoing work and consistently show your progress. A huge part of a successful retainer is your ability to manage client expectations right from the start.

Follow these steps to build a retainer that lasts:

- Define the Scope of Work: What exactly will you do each month? Get specific. It could be "up to 10 hours of strategic SEO support," "management of a $5k/month ad budget," or "four new blog posts and one email newsletter."

- Set the Communication Cadence: How and when will you connect? Nail this down upfront. Maybe it’s a weekly 30-minute call or a monthly performance report sent on the first business day of the month.

- Determine the Monthly Fee: Price the retainer based on the value and effort of the monthly work. You can calculate this using a set number of hours or simply a flat fee for the package of deliverables you've agreed on.

- Include a "Reset Clause": This is a game-changer. Add a term to your contract that allows for a review of the retainer scope and fee every 3 or 6 months. This ensures the arrangement can grow with the client's business and always feels fair to both of you.

Pro Tip: The Hybrid "Project-to-Retainer" Model

Looking to get the most out of every client relationship? Try combining a project with a retainer. Start with a larger, one-time project to do the heavy lifting—like building out a new sales funnel or launching a core product.

Then, once that foundational work is done, transition the client to a smaller monthly retainer for ongoing support, maintenance, and optimization. This model gives you a nice chunk of cash upfront while locking in that predictable, long-term revenue. It’s the best of both worlds.

By moving from abstract ideas to concrete steps, you can start using these powerful consulting pricing strategies with real confidence. It all boils down to clear definitions, honest estimates, and proactive communication.

Mastering the Art of Value-Based Pricing

Do you ever feel like your invoice doesn't quite match the massive impact you just had on a client's business? You deliver a game-changing result, but the fee feels insignificant compared to the millions you just made or saved them.

This is a classic problem. It’s the core frustration that pushes experienced consultants toward value-based pricing—what many consider the pinnacle of consulting fee strategies.

This approach requires a total mental shift. You stop selling your hours or even a pre-defined project. Instead, you start selling what clients really want: tangible, measurable business results.

Kicking Off the Value Conversation: A Step-by-Step Approach

So, how do you actually price on value? First, you have to figure out what that value is. This means you need to get comfortable asking the tough, money-focused questions. Your goal is to guide the client to articulate the economic impact of their challenge themselves.

- Listen for the Pain: In your initial calls, listen for phrases like "we're losing customers," "our process is too slow," or "we're worried about compliance." These are your entry points.

- Ask Questions to Quantify: This is the critical step. Turn their pain into a number.

- To Uncover Revenue Opportunities: "If we could boost your lead conversion rate by just 10%, what would that mean for top-line revenue over the next year?"

- To Identify Cost Savings: "How much is this supply chain inefficiency costing you each quarter in extra shipping fees and wasted materials?"

- To Quantify Risk Mitigation: "What’s the potential financial penalty if you fail the upcoming regulatory audit?"

- Frame the Value: Once you have a number, frame it clearly. It almost always falls into one of three buckets: Increasing Revenue, Decreasing Costs, or Mitigating Risk.

A huge part of mastering this is clearly articulating the financial upside and return on investment (ROI) a client can expect. This often requires a solid understanding a client's financial performance, which is vital for accurately quantifying the value you can deliver.

Real-World Use Case: The Consultant Who Found a Million-Dollar Leak

A logistics consultant, Sarah, was hired by an e-commerce company struggling with shipping delays. Instead of quoting her hourly rate, she started asking questions. She quickly discovered their inefficient packing process was costing them an average of $85,000 per month in extra shipping charges, damaged goods, and wasted labor.

Annually, this was a $1.02 million problem. Sarah proposed a project to completely redesign their fulfillment workflow. She projected it would slash at least 90% of that waste, saving them over $900,000 in the first year alone.

She confidently priced her six-week project at $90,000. The client saw it not as a cost, but as a small investment to unlock nearly a million in savings. They signed immediately. Had she charged hourly, she would have earned a tiny fraction of that for the exact same work.

Handling Common Client Objections

When you propose a five or six-figure fee—even one backed by immense value—expect a little pushback. It's natural. The key is to calmly re-anchor the conversation back to the ROI, not the price tag.

Objection: "That's more than we budgeted for."

Response: "I understand this is a significant investment. Let's look at the numbers we agreed on again. We projected this would save you over $900,000 in the first year. Looking at it that way, does an investment of $90,000 to capture those savings feel more manageable?"

Objection: "Why is your fee so high? It won't take you that long."

Response: "You're right, my fee isn't based on time. It's based on the decades of experience that allow me to solve this specific, million-dollar problem for you so efficiently. You aren't paying for my hours; you're investing in the result."

The 10x Value Rule: A Pro Tip

As a simple rule of thumb, aim to charge roughly 10% of the value you create for the client. If you can confidently show that your work will generate $500,000 in new revenue or savings in the first year, a $50,000 fee is easy to justify. This 10x rule gives you a strong, defensible starting point and makes the ROI crystal clear.

Mastering value-based pricing is the single most powerful lever for growing your consulting practice. It aligns your success directly with your client's, transforming you from a simple vendor into an indispensable partner.

How to Choose the Right Pricing Strategy

Staring at the four pricing models can feel like standing at a crossroads without a map. You get the theory behind each one, but when a real client is waiting for a proposal, which path do you actually take? The secret isn't finding the one "best" strategy. It's about asking which is best for this specific situation.

A quick first step: is the project scope crystal clear or is it more of an exploration? A well-defined scope almost always points toward a project-based fee. An ambiguous, "we need to figure it out" scope is a perfect candidate for hourly rates. That single question can cut your options in half right away.

A Step-by-Step Framework for Your Decision

Making a confident choice requires balancing the nature of the work with your own business goals. It boils down to three things: your experience level, the type of service you offer, and how savvy your client is.

For instance, newer consultants often lean on project-based fees to build their portfolio and confidence. On the other hand, if you're a seasoned expert, you should be actively steering conversations toward value-based pricing where you can.

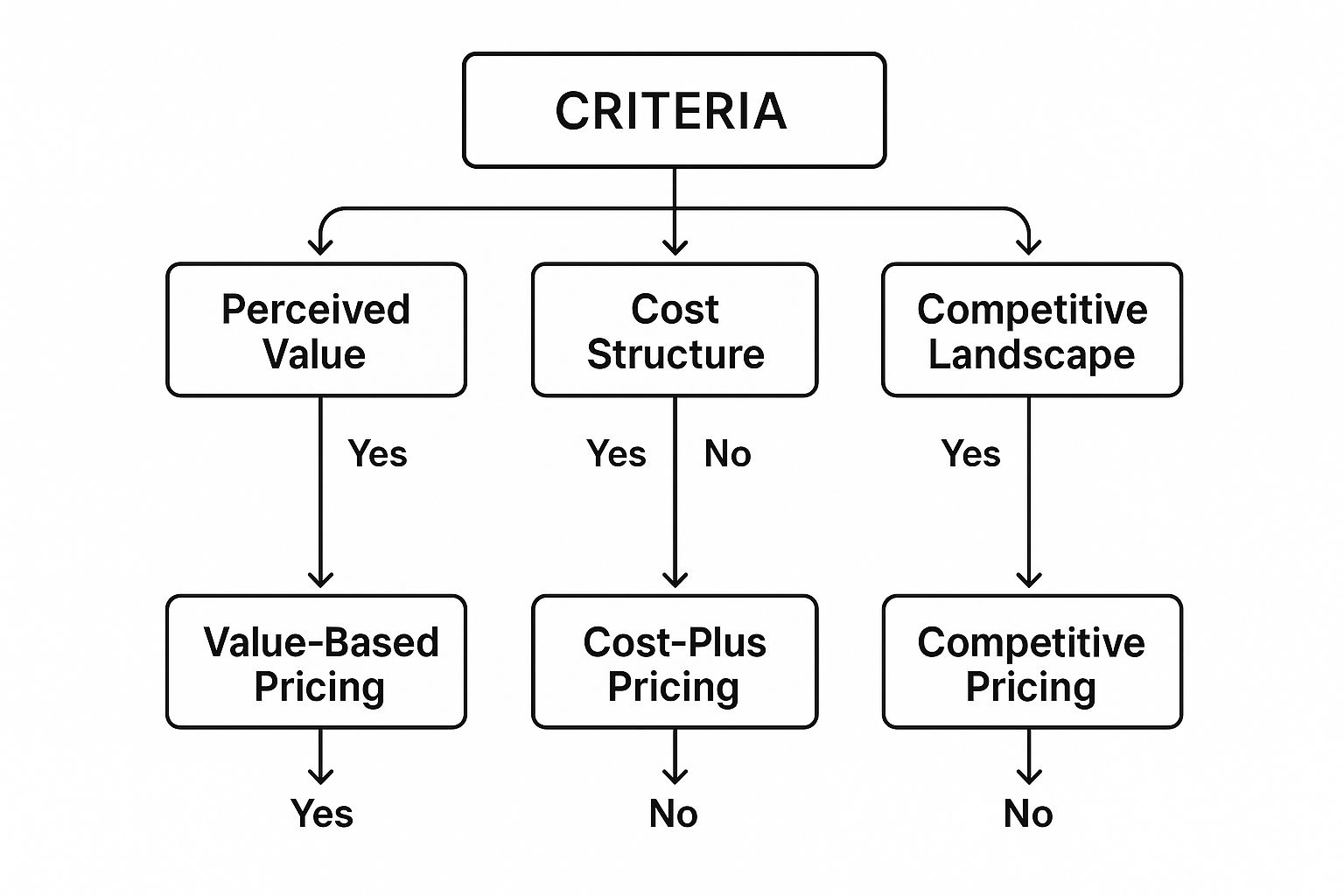

To help you see the path forward, this decision tree maps out the key factors that point to the most logical pricing model for your situation.

This visual guide cuts through the noise. It connects core business drivers—like the client's perceived value of your work and the competitive pressures you face—directly to the pricing model that makes the most sense.

Real-World Use Case: Choosing a Hybrid Strategy

Let's walk through a real-world example. Imagine a software consultant, Maria, who gets a call from a mid-sized company looking to overhaul its ancient inventory system.

Phase 1 - Hourly Discovery: The client knows they have a problem, but the solution and scope are unknown. Maria proposes a $5,000 discovery phase billed hourly. This lets her perform a deep-dive audit and create a concrete project plan without committing to a massive, unknown scope.

Phase 2 - Project-Based Implementation: Once discovery is done, Maria has a crystal-clear picture of the work ahead. She confidently presents a $45,000 fixed-price project to build and implement the new system, complete with specific milestones and deliverables. The client, now armed with a solid plan, happily signs on.

Phase 3 - Retainer for Support: After a successful launch, Maria offers a $2,500 monthly retainer for ongoing support, system maintenance, and user training. This move secures her a predictable income stream while ensuring the client gets lasting value from their investment.

By blending three different pricing models, Maria masterfully de-risked the engagement for herself, built trust with the client, and ultimately maximized her total earnings.

External Factors and Pricing Reviews

Your pricing isn't something you can just set and forget. The economy plays a huge role. For example, the Producer Price Index (PPI) for management consulting is a great indicator of what’s happening in the market. It tracks the average change in what consultants are charging over time.

This index has seen some serious swings, from a peak of 106.7 in 2010 to a low of 62.9 in early 2021, reflecting periods of intense pricing pressure followed by recovery. Keeping an eye on trends like these helps you know if your rates are in line with the broader market. You can dig into these producer price trends on TradingEconomics.com to stay informed.

Pro Tip: The Growth-Oriented Choice

Your pricing model should be a tool that helps you reach your business goals.

- If you need to sign clients fast, a low project fee (penetration pricing) might be the ticket.

- If you’re all about profitability and efficiency, value-based pricing is your north star.

- But if you're trying to build a sustainable, scalable business, retainer agreements are pure gold. They deliver the predictable revenue you need to reinvest in growth. For more on this, check out our guide on how to scale a service business.

Choosing the right consulting price is a dynamic skill, not a static formula. By carefully analyzing the project, your own experience, and your client’s needs, you can pick the perfect model for any engagement that comes your way.

Frequently Asked Questions About Consulting Pricing

Even after you've landed on the right pricing model, the real world will throw you some curveballs. What do you do when a client balks at your price? Or when it's time to have that slightly awkward conversation about raising your rates?

Let's walk through how to handle the most common questions with actionable, step-by-step guidance.

What Do I Do When a Client Says My Price Is Too High?

It’s a phrase that can make your stomach drop. Your first instinct might be to cave and offer a discount, but don't. That immediately signals that your initial price was inflated and devalues your expertise. Instead, follow this three-step process:

- Acknowledge and Inquire. First, validate their concern. "I appreciate you sharing that, and I understand this is a significant investment. Could you help me understand which part of the proposal is causing hesitation?"

- Re-Anchor to Value. Gently guide the discussion back to the problem you're solving. "I hear you on the fee. Let's quickly look back at the $250,000 in projected annual savings we identified. This project is structured to deliver a return of over 5x in the first year alone."

- Offer Options, Not Discounts. If the budget is a hard limit, modify the scope. "To work within your $15,000 budget, we could focus on the initial audit and strategy phase now. We can then tackle the implementation as a separate project next quarter." This protects your rate while still giving them a path forward.

How Often Should I Raise My Rates for Existing Clients?

This is a delicate dance. A good rule of thumb is to review your rates annually. When you do decide it's time for an increase, give them plenty of warning—at least 60-90 days is professional and respectful. Here's a practical example:

Mini Case Study: The Graceful Rate Increase A freelance web developer had been on a retainer with a marketing agency for two years at the same rate. Three months before the contract renewal, she sent a proactive email. She didn't just announce a price hike; she highlighted the new efficiencies she'd brought to their projects and the better results they were seeing. She then presented her new rate—a 15% increase. Because she gave ample notice and tied the increase directly to the added value she was providing, the client happily agreed.

What Are the Biggest Consulting Pricing Mistakes to Avoid?

Sometimes, success is more about what you don't do. Steer clear of these common pricing traps:

- Forgetting Non-Billable Time: Your rate has to cover all the behind-the-scenes effort: marketing, sales calls, admin, and your own professional development. Forgetting this is the fast track to being "busy but broke."

- Working Without a Formal Agreement: Never start a project on a handshake. A clear, signed contract or Statement of Work (SOW) is your best friend. It protects both you and the client by explicitly detailing the scope, deliverables, timeline, and payment terms. You can build, send, and get these signed directly within growlio.

- Undercharging Out of Fear: This is easily the most destructive mistake. Setting your prices too low doesn't just starve your business of revenue; it can also make potential clients think your work is low-quality. Price with confidence, based on the incredible value you deliver.

You've learned the strategies and you know how to navigate the tricky conversations. The only thing left is to put this knowledge into action.

Ready to build proposals that win, manage projects without the chaos, and get paid on time? Start your free growlio account today and take full control of your consulting business.