Chasing down late payments is a massive headache, right? It drains your time, strains client relationships, and makes your cash flow unpredictable. The quick win? A professional payment plan contract. It’s the single best tool to stop the awkward follow-ups and ensure you get paid on time, every time.

Stop Chasing Payments and Start Getting Paid

We've all been there—sending that third "gentle reminder" email for a past-due invoice. It's frustrating, right? It chews up time you should be spending on growing your business and can make things feel tense with your clients. When you don't have a formal agreement, you're essentially operating on goodwill, and that's just not a reliable financial strategy.

A well-crafted payment plan replaces that ambiguity with crystal-clear expectations for everyone involved. It’s not just about getting paid on time; it’s about safeguarding your business and, believe it or not, preserving the client relationship. A formal contract takes the emotion out of the equation. You're no longer chasing anyone down—you're simply following the terms you both agreed to from the start.

Real-World Use Case: A Web Designer's Win

Let's look at a real-world example. A freelance web designer I know just wrapped up a $5,000 project. The client loved the work but hit a snag with the lump-sum payment.

Instead of letting the invoice go stale, the designer proactively suggested a payment plan: $2,000 upfront, followed by three monthly payments of $1,000. She formalized this with a simple contract generated in growlio, which locked in the project, made the cost manageable for her client, and kept her own cash flow healthy.

Her contract was straightforward and included a few key things:

A clear schedule of payment dates and amounts.

A late fee clause in case a payment was missed.

A note specifying that the final website files would only be transferred after the last payment cleared.

This simple, proactive step saved the client relationship and ensured she got paid in full without any of those dreaded "just checking in" emails.

Pro Tip: Don't just send the contract and hope for the best. Inside growlio, you can link your contract directly to automated invoices. When a client e-signs the agreement, a recurring invoice schedule is automatically created. This automates the whole thing, from the initial agreement to the final payment reminder, so nothing ever slips through the cracks. It also helps to understand the difference between key financial documents. You can learn more about billing vs invoicing to really tighten up your financial workflow.

Ready to take control and put an end to chasing down payments for good? It all starts with putting a clear, professional contract in place.

Breaking Down a Bulletproof Payment Agreement

Have you ever looked at a contract and felt like you needed a law degree just to get through the first page? We've all been there. That feeling of uncertainty is exactly why so many agreements fail to protect people when things go wrong. The secret isn't complicated legal jargon; it's absolute clarity.

A solid payment plan contract sample is your roadmap for the entire client relationship. When you understand the "why" behind each section, a simple template transforms into a protective shield for your business. These agreements are essential in today's economy, helping you manage cash flow while making your services accessible to more clients.

Think about it: major payment processors handle billions in transactions every year, which just goes to show how vital these structured payment plans have become. A well-crafted contract is simply non-negotiable.

Step 1: Identify Who Is Actually Involved

This sounds almost too basic to mention, but you'd be surprised how often it gets messed up. Simply putting "the client" isn't going to cut it in a dispute. Your contract needs the full, legal names of every person or business involved, along with their main addresses and contact details.

For instance, don't just write "Jane's Bakery." Instead, specify "Jane's Bakery LLC, a limited liability company registered in the state of California." That level of precision is what makes an agreement legally enforceable.

Step 2: Define What You Are Actually Delivering

Vagueness is your worst enemy in a contract. Avoid generic descriptions like "website design services." You need to get granular and spell everything out.

Deliverables: "A five-page responsive website including a homepage, about page, services page, contact page, and blog."

Revisions: "This agreement includes up to two rounds of major revisions. Any further revisions will be billed at an hourly rate of $150."

Exclusions: "Logo design, copywriting, and ongoing website maintenance are not included in this scope of work."

This approach shuts down scope creep before it starts and makes sure everyone is on the same page. If you want to dive deeper into structuring service agreements, our guide on creating a proposal and contract template is a great resource.

Step 3: Clarify How (and When) You Get Paid

Your payment schedule should be so clear that a five-year-old could understand it. It needs to list the exact amount and due date for every single payment. No exceptions.

Key Takeaway: Treat your payment schedule like a simple instruction manual. Using a table right in the contract is the best way to list each payment date, the amount due, and the required payment method. For example: "Payment 1: $1,000 due March 1st, 2024 via ACH transfer."

This eliminates any room for misinterpretation. It also creates a clear trigger for when a payment is officially late, which brings us to the next critical piece.

Step 4: State What Happens When a Payment Is Late

Life happens, and sometimes payments are missed. Your contract must define what officially counts as a default—for example, a payment that is more than 15 days late. Then, you need to state exactly what happens next.

Clearly outline the consequences. This could be a late fee, a pause in your services, or both, until the account is back in good standing.

Pro Tip: Make sure your late fee clause is reasonable and complies with state or local laws. Instead of a high percentage that can feel punitive, a flat fee like "$50 for any payment more than 10 days overdue" is often easier to enforce and looks more professional.

By carefully defining each of these core components, you’re creating more than just a document. You’re building a foundation of trust and transparency that secures your income. The next logical step is to take this framework and automate it so you can spend less time on paperwork and more time on your business.

Making Your Contract Work in the Real World

Staring at a generic contract template can feel a little disconnected from reality. You know it’s a solid foundation, but what do you do when your project is unusually complex, a new client seems a bit risky, or you're selling a physical product instead of a service? A one-size-fits-all agreement just won't cut it.

The real skill lies in tweaking your base payment plan contract to fit the unique contours of each deal. Taking this step from the beginning isn't just about protecting your business from headaches like scope creep and late payments; it shows your clients you're a true professional who has thought everything through.

Mini-Case Study: A Marketing Agency's Smart Pivot

I saw this play out perfectly with a marketing agency I know. They were excited to land a promising startup client, but after the first phase, the startup’s cash flow tightened up, and payments started lagging. Instead of letting the relationship get tense, the agency’s account manager suggested a new payment schedule.

They shifted their standard contract to a milestone-based structure. Suddenly, payments were directly tied to tangible results: launching the new ad campaign, hitting a specific lead generation goal, and delivering the Q3 performance report. This simple adjustment gave the client some much-needed breathing room and linked the agency's pay to the value they were delivering, rebuilding trust and getting the cash flowing again.

Finding the Right Agreement Structure

Not all payment plans are built the same, and they shouldn't be. The structure of your contract needs to reflect the way you work. For one-off projects with a clear beginning and end, milestone payments are often the best fit. But for long-term, ongoing work, a recurring payment model is usually the way to go.

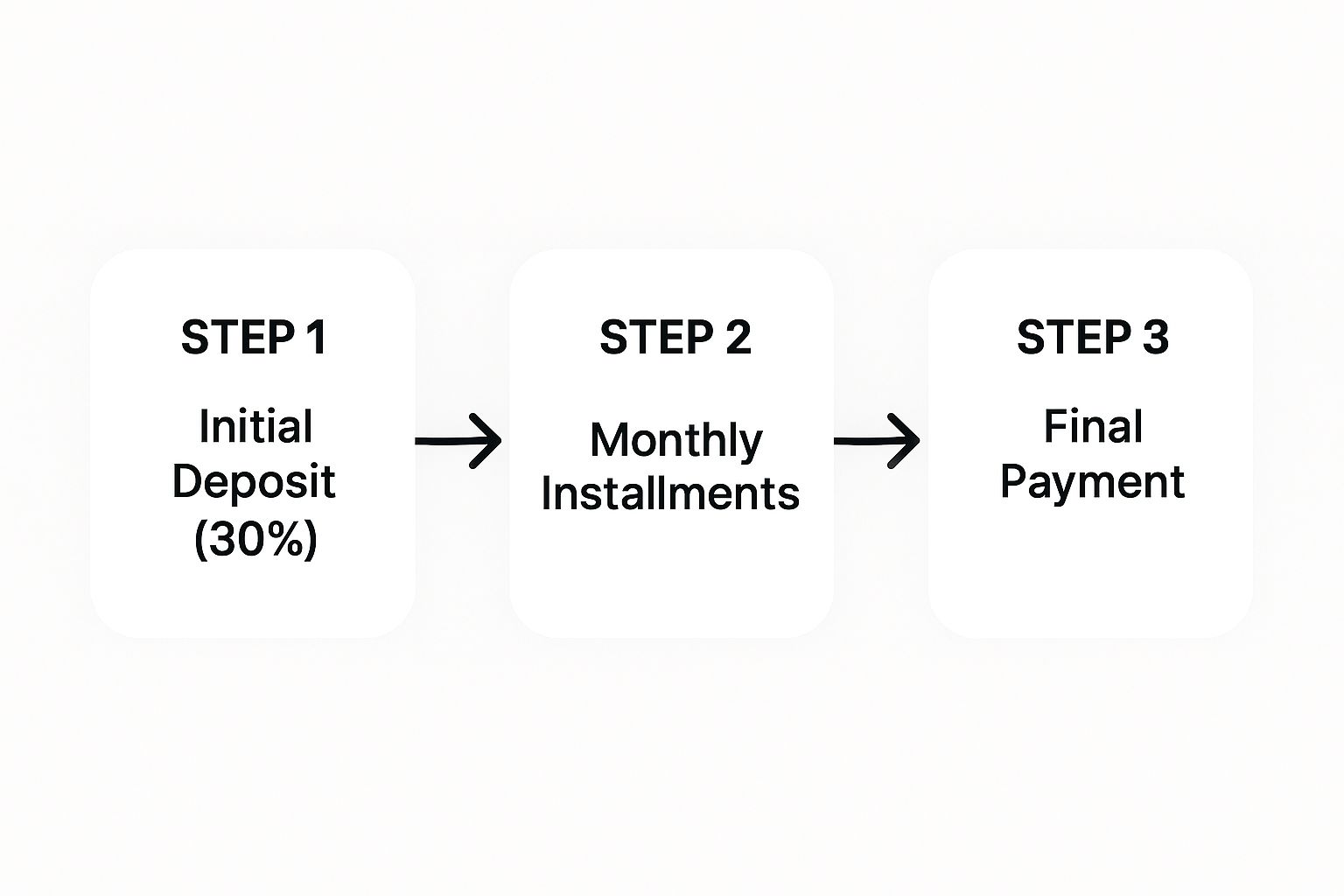

Here’s a typical payment flow for a project that requires an initial deposit.

As you can see, breaking down a large project fee into smaller, more manageable chunks—like an upfront deposit, a few installments, and a final payment—creates a financial timeline that everyone can see and plan for.

For services that are continuous, like ongoing SEO or social media management, you’ll want a different approach. Many agencies in this space operate on retainers, which secure a set amount of your time each month for a fixed fee paid upfront. If you’re building long-term client relationships, it’s worth learning more about what is a retainer agreement and how to structure them properly.

Expert Tip for High-Risk Situations When you're working with a brand-new client who has no payment history, or if your project requires a significant upfront investment in materials, a non-refundable deposit clause is your best friend. Make it crystal clear that the initial payment—say, 30% of the total project cost—is non-refundable to cover your initial setup, research, and resource allocation. This shields you from a major financial hit if the client decides to walk away.

By thoughtfully adapting your contract, you transform it from a simple piece of paper into a strategic tool. It becomes a flexible asset that helps you navigate challenges, secure your income, and ultimately build stronger partnerships with your clients.

Automating Your Payment Plan Process

Are you drowning in spreadsheets trying to track who has paid, who's late, and when the next reminder needs to go out? If you're managing payment plans manually, you know it’s a recipe for missed payments and hours of administrative headaches. The best move you can make is to ditch the paper trail and adopt an automated system that does the heavy lifting for you. It’s the key to getting paid on time without all the chasing.

This isn’t just about convenience; it’s about keeping up with how business gets done now. We’re seeing a massive shift away from old-school payment methods. Predictions point to a 40% drop in cash use by 2025, while Real-time Payments (RTP) are projected to handle a staggering 575 billion transactions worldwide by 2028. This technology allows you to set up payment plans with instant fund transfers, which can be a game-changer for your cash flow.

From Manual Mess to Automated Success

I once worked with a creative agency that was losing nearly a full day every single month just to reconcile payments. It was a mess. Their workflow involved manually creating invoices, emailing PDF contracts for clients to print and sign, and then clogging up their calendars with reminders to chase down late payers. Not only was it inefficient, but it also forced them into some pretty awkward conversations.

They finally made the switch to a platform that combined e-signatures with automated recurring billing. The change was immediate. Now, a client just signs a payment plan contract digitally, and the system takes over, automatically charging their card on the scheduled dates. Late payment reminders? Those go out automatically, too. The entire collections process was completely transformed, almost overnight.

Setting Up Your Hands-Off System: A Step-by-Step Guide

Building an automated workflow is easier than it sounds. It’s about connecting a few smart digital tools to create a smooth, professional experience for your clients.

Step 1: Use Digital Signatures. Get a tool like growlio that lets clients sign contracts electronically. It’s faster, more secure, and just as legally binding as a wet-ink signature.

Step 2: Set Up Recurring Invoicing. In your growlio dashboard, you can configure the system to automatically generate and send invoices a few days before each payment is due.

Step 3: Enable Automated Payments. Integrate with a payment gateway (like Stripe or PayPal through growlio) that can securely save a client’s payment method and automatically charge it on the due date.

For a deeper dive into setting this up, check out this guide to automate invoice processing efficiently. A hands-off approach like this is what creates a steady, predictable cash flow.

Pro Tip: Advanced Automation

You can take this a step further by setting up rules to handle payment issues. For instance, in growlio, build a workflow where a failed payment automatically triggers a "Please Update Your Payment Method" email. If three days go by with no action, the system can send a second, more urgent notification that also CCs your accounts team to flag it for a personal follow-up.

Having the right software is what makes this all click into place. A modern platform should be able to do this all for you.

Common Legal Pitfalls and How to Avoid Them

Ever had that sinking feeling that a contract you signed might not hold up if things go south? That’s a fear that keeps a lot of business owners up at night. A payment plan contract is only as good as its enforceability, and believe me, a few common mistakes can render it totally useless right when you need it most.

Knowing what these pitfalls are is half the battle. You don’t need a law degree, but a little awareness about compliance and clarity can save you from a world of hurt later on.

Vague Language is Your Worst Enemy

If there’s one thing that will kill a contract, it’s ambiguity. Vague terms like "timely payments" or "reasonable efforts" are just invitations for a dispute because they're completely subjective. If you end up in a disagreement, a judge is going to look for specifics, not fuzzy promises.

Get rid of the guesswork and be crystal clear.

Instead of: "Payments are due at the beginning of the month."

Try this: "Payment of $500 is due on or before the 1st calendar day of each month."

Instead of: "Services will be paused if payments are late."

Try this: "All work will cease if payment is not received within 15 days of the due date."

This kind of detail leaves zero room for misinterpretation. The clarity in your agreement is just as critical as the clauses in a website development contract template, where specific deliverables and deadlines are everything.

A Freelancer's Costly Mistake I once knew a freelance designer who used a generic contract that just said a "late fee" would apply. It didn't specify the amount or when it kicked in. When a client paid six weeks late, the designer tried to add a 10% fee. The client flat-out refused, arguing the contract was too vague. Because the terms weren't defined, the designer had no legal ground to stand on and had to eat the cost.

Navigating State and Federal Regulations

Here's something a lot of people miss: you can't just put whatever terms you want into a contract. You have to play by the rules, and that means complying with state and federal laws, especially around interest rates and consumer protection.

For example, charging sky-high interest can violate usury laws, which cap the maximum rate you can legally charge.

This isn't a static field, either. We're seeing a huge global push for more transparency in payment agreements. In the U.S. alone, the regulatory landscape is a complex web of rules. By 2025, many states are expected to roll out new laws that could make compliance even trickier for businesses offering installment plans. You can find some great insights on these top trends in international payments on gtlaw.com.

Pro Tip: When to Call a Lawyer A solid template is great for the straightforward stuff—I’d say it covers about 80% of standard agreements. But you absolutely need to consult a lawyer if your contract involves:

High-value transactions (anything over $10,000 is a good rule of thumb).

Complex intellectual property rights.

Interstate or international clients, since laws can differ dramatically.

Charging interest rather than just a simple late fee.

A small legal investment upfront can prevent a massive financial disaster down the road.

By sidestepping vague terms and staying on top of legal requirements, you can draft a payment plan that not only looks professional but actually gives you real, enforceable protection.

Time to Put Your Payment Plan in Motion

You've walked through the ins and outs of building a solid payment agreement. Now it's time to move from theory to practice. Don't let a stack of templates be the last hurdle standing between you and a more predictable cash flow. It's time to stop chasing down late payments and start putting what you've learned into action.

The next step is all about implementation. Take our payment plan contract sample and the detailed clause breakdowns we covered and start building your own bulletproof agreement. This isn't just about shuffling paperwork—it’s about taking control and shifting from reactive collections to proactive financial strategy.

Ditching Manual Work for a Smarter Workflow

I once worked with a small consulting firm that was drowning in administrative tasks. They were spending nearly 10 hours a month just creating, sending, and following up on PDF contracts and individual invoices. It was a massive resource drain and, frankly, it created unnecessary friction right at the start of a new client relationship.

They made the switch to a unified platform, and it completely changed their process. What used to be a multi-step headache became a single, streamlined action. An approved proposal instantly converts to a contract, gets e-signed, and kicks off an automated payment schedule, all in a matter of minutes. They got those lost hours back and instantly looked more professional to every new client.

Pro Tip: Get Ahead of Renewals

You can take this a step further. Use your client management system to automatically set reminders for contract renewals 60 days out. This gives you a comfortable window to open a conversation about a new agreement, adjust the scope, and lock in the partnership for another term. No more last-minute scrambles or awkward gaps in service.

This level of control isn't some far-off dream. You have the knowledge and the tools to make your business more stable and efficient, starting right now.

The final piece is bringing it all together. Ready to see just how simple it can be to manage your agreements, projects, and payments from a single dashboard? Start your free growlio account at growlio.io and see the difference for yourself.

Your Questions, Answered

Even with a great template, you're bound to have some questions. That’s perfectly normal. Getting the small details right is what makes a payment plan work. Let's dig into a few of the most common things business owners ask so you can finalize your contract with confidence.

What Happens If a Client Violates the Contract?

This is the scenario no one wants, but your contract is your playbook for when things go wrong. If a client misses a payment, your first move should always be to follow the exact steps you laid out in the agreement.

Typically, this means sending a formal written notice about the breach and giving them a set amount of time to make it right.

If they still don't resolve the issue, you can then enforce the consequences you defined, like applying late fees or putting a stop to all work. Your signed payment plan contract sample is the critical piece of evidence you’ll need if you have to take things further.

Is a Digital Signature Legally Binding?

Yes, absolutely. In most parts of the world, including the United States and the European Union, electronic signatures carry the same legal weight as a wet ink signature.

The key is to use a reputable e-signature service. These platforms provide a secure audit trail that proves who signed the document and when, making it a reliable and incredibly efficient way to finalize agreements without the hassle of printing and scanning.

Can I Charge Interest on a Payment Plan?

You can, but you have to be very careful here. You are legally required to follow state and local usury laws, which put a hard cap on the maximum interest rate you can charge. If you go over that limit, your entire agreement could be voided.

Frankly, it's often much simpler and safer to just charge a flat, pre-agreed-upon "late fee" for missed payments. If you’re set on charging interest, be sure the rate is crystal clear in the contract and, most importantly, legal where your business operates.

Pro Tip for High-Ticket Plans: For bigger projects with longer payment timelines (say, over 12 months), it's smart to have a lawyer look over the interest clause. They'll make sure your terms are enforceable and protect you from legal headaches down the road. A small investment upfront can save you a fortune later.

Ready to put all this into practice? It's time to stop chasing payments and start building a more predictable cash flow. With a tool like growlio, you can create, send, and automate your client agreements all from one place.

Start your free growlio account at growlio.io and discover how much easier managing your client relationships can be.